Investors have long been intrigued by the world of gambling due to its potential for high returns and continuous innovation. However, as with any industry linked to entertainment and financial gains, it presents a delicate equilibrium between risk and reward. In this article, I invite you to join me in exploring this unique business sector and addressing a pressing question on the minds of many investors: How can we reconcile investment growth with transparency in the operations of gambling companies?

Today, I want to take you on a journey into the realm of gambling, where stakes are high, and investment opportunities are more enticing than ever. Together, we will delve into how regulatory authorities and the industry itself are striving to ensure compliance with transparency standards while safeguarding the interests of both players and investors. I will conduct an analysis of diverse markets and regions, shedding light on which companies are regarded as benchmarks for transparency.

Europe’s Gold Standard of Transparency

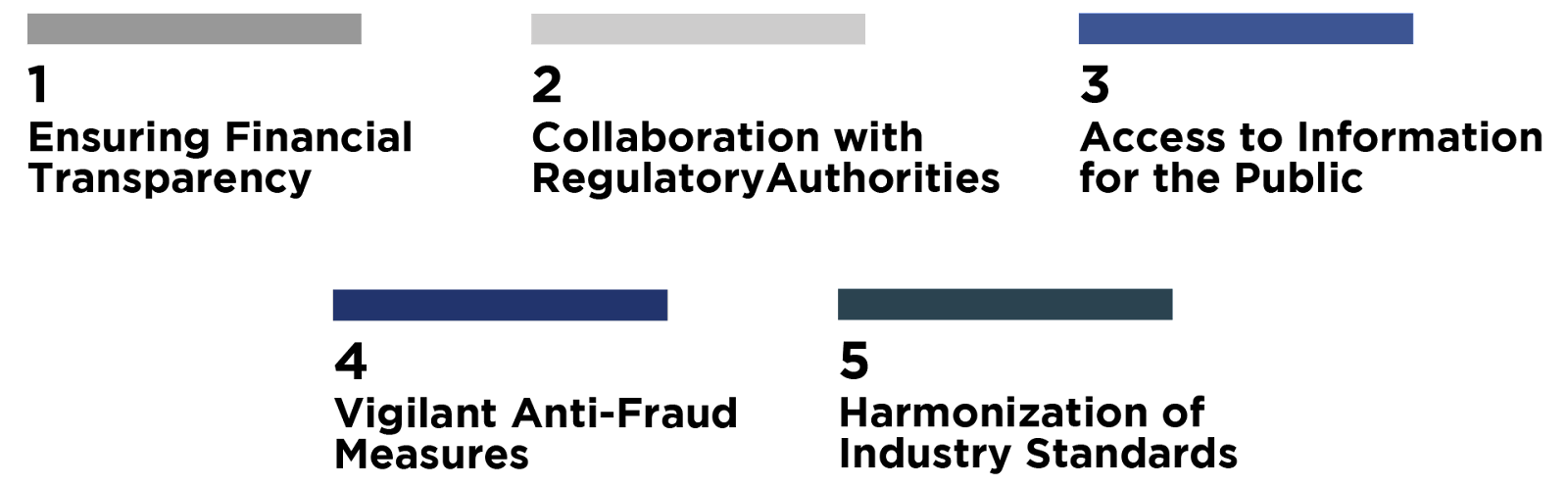

In Europe, gambling companies are held to rigorous standards of transparency, which encompass extensive financial reporting, in-depth disclosures, and a firm dedication to responsible gaming practices. Some of the key transparency standards in Europe include:

- Ensuring Financial Transparency:

European gambling companies are obliged to provide comprehensive financial reports. In adherence to EU directives, public companies must publish annual reports that detail profits and losses, balance sheets, and cash flows. Notable European gambling giants, such as Bet365 and Flutter Entertainment, stand as prime examples of financial transparency. - Collaboration with Regulatory Authorities:

In Europe, countries benefit from robust regulatory bodies that play a pivotal role in upholding industry standards. Leading European gambling companies, such as Kindred Group and Entain, actively collaborate with these regulatory authorities to ensure compliance. - Access to Information for the Public:

Transparency extends to granting the public and investors access to a wealth of information related to licenses, financial reports, and industry statistics. Esteemed European gambling operators like William Hill and 888 Holdings proactively engage with the public and investors to provide this valuable information. - Vigilant Anti-Fraud Measures:

European nations have implemented stringent measures to combat fraudulent activities and money laundering within the gambling industry. Prominent European players like Unibet allocate significant resources to bolster their anti-fraud measures. - Harmonization of Industry Standards:

The European Union is actively engaged in the harmonization of regulations and standards across member states within the gambling industry. Recognized companies like Rank Group are supportive of the EU’s ongoing efforts to establish unified industry standards.

These transparency standards underscore Europe’s dedication to upholding integrity and trust within the gambling sector. They set a precedent for other regions aiming to achieve a harmonious equilibrium between enticing investments and maintaining industry credibility.

Now, let’s delve into a selection of prominent European gambling companies that consistently adhere to these transparency standards:

In the realm of gambling, transparency plays a pivotal role, exerting a substantial influence on both investors and players alike.

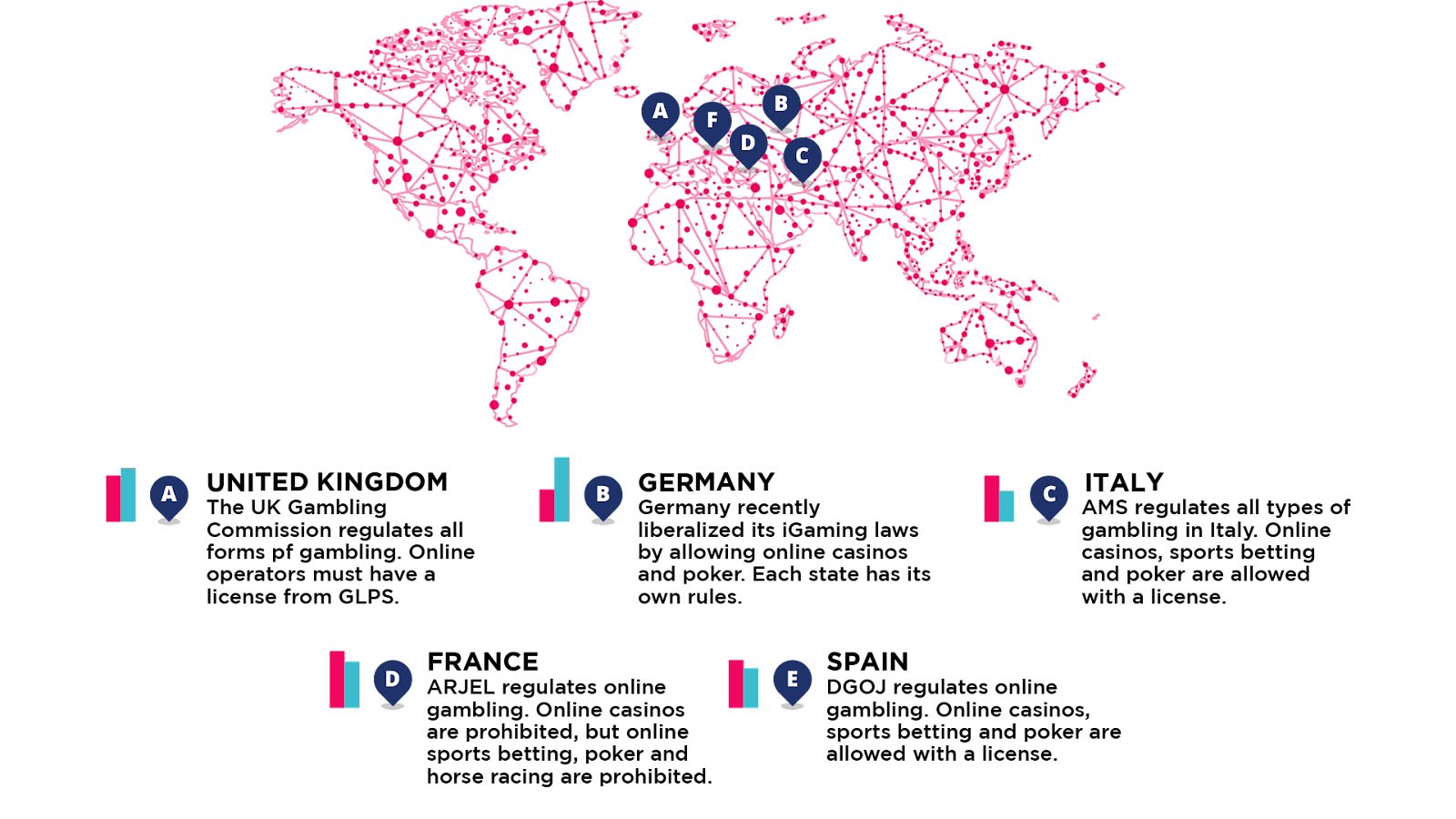

Comparing Transparency Across Regions: Contrasting Degrees of Openness

I will conduct a comparative examination of regions characterized by varying levels of transparency, illuminating how some prioritize openness while others may lag behind. Let’s embark on this analytical journey:

- Region 1: Asia – Progressing Towards Transparency

The Asian gambling industry, experiencing rapid growth, confronts persistent challenges related to transparency. Some Asian nations have initiated regulatory and disclosure reforms, but opportunities for improvement persist. In Macau, a prominent Asian gambling hub, efforts are being made to bolster transparency. The Macau Gaming Inspection and Coordination Bureau (DICJ) issues annual reports that offer insights into the regional gambling landscape. However, there is still room for enhancement in terms of financial reporting by gambling operators. - Region 2: North America – A Mosaic of Transparency

Transparency within the North American gambling sector exhibits a diverse panorama. While certain U.S. states have embraced stringent reporting requirements, others maintain a less transparent stance. Nevada, renowned for Las Vegas, upholds rigorous financial reporting standards. The Nevada Gaming Control Board (NGCB) releases comprehensive financial data, cementing the state’s reputation for transparency. Nevertheless, uniform practices have not been adopted across all U.S. states. - Region 3: South America – Nurturing Transparency

South America’s burgeoning gambling industry is in its nascent phase, and transparency measures are in the process of evolution. Numerous countries are taking proactive steps to bolster disclosure and accountability.

In Colombia, where a regulated online gambling market exists, the regulatory body Coljuegos demonstrates commitment to transparency by regularly publishing data. This information includes details about licensed operators, tax revenues collected, and initiatives aimed at combating illegal gambling. Colombia’s efforts signify significant progress in the region’s ongoing pursuit of enhanced transparency within the gambling sector.

As I delve into the intricacies of the gambling industry’s pursuit of transparency, I arrive at a crucial juncture where technological innovation merges with our commitment to openness. This intersection marks the true shaping of the industry’s future.

Navigating Toward Transparency and Technological Advancement

As transparency guides the way, the industry stands ready to harness technological advancements like never before.

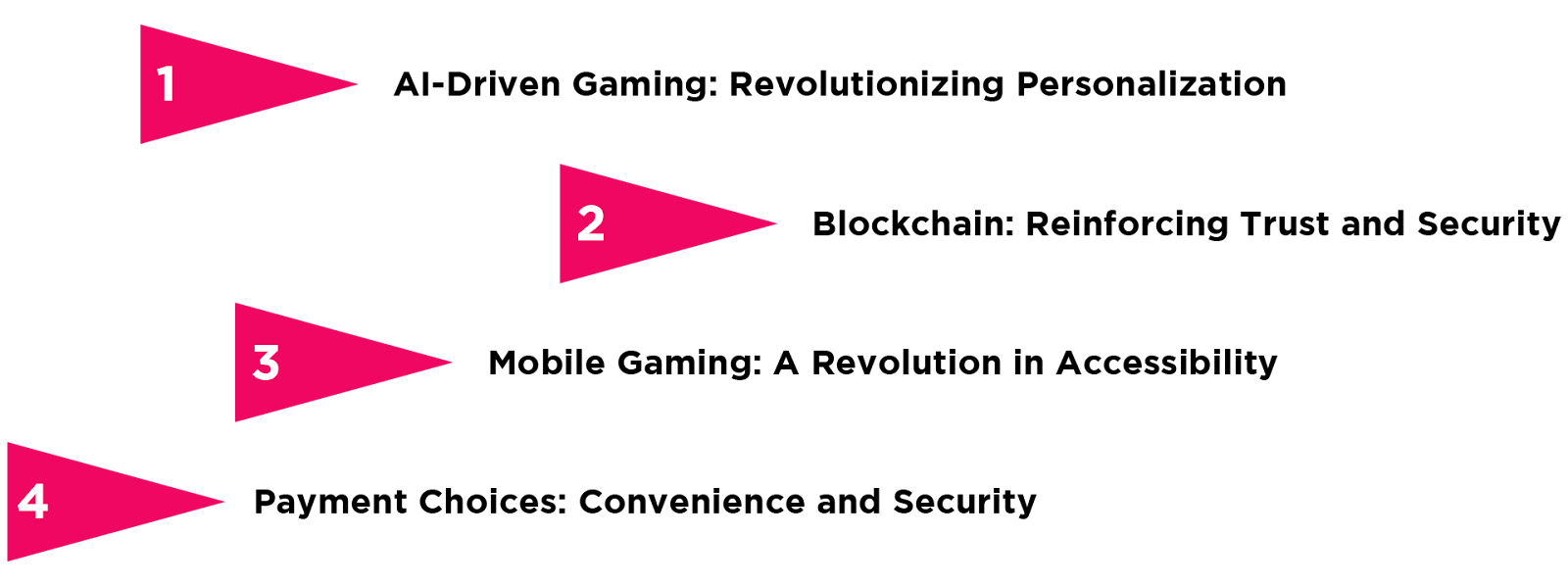

- AI-Driven Gaming: Revolutionizing Personalization

Envision a world where the games you play adapt to your preferences, crafting a customized experience. Innovative firms like The Stars Group are transforming this vision into reality through AI-driven gaming. These intelligent systems not only elevate player engagement but also ensure equity and responsiveness, ushering in an era of immersive gameplay. - Blockchain: Reinforcing Trust and Security

Security has always been paramount in the gambling industry. Enter blockchain, an innovation that not only fortifies game integrity but also safeguards player data. Companies like 888 Holdings are spearheading this blockchain revolution, offering secure payment alternatives through cryptocurrencies while protecting sensitive information. - Mobile Gaming: A Revolution in Accessibility

The ubiquity of smartphones has propelled the mobile gaming revolution. Industry leaders like Flutter Entertainment are ensuring players can enjoy their beloved games at any time and place. Mobile gaming democratizes access to the world of casinos, enabling players to carry their preferred pastimes in their pockets. - Payment Choices: Convenience and Security

Diverse payment options are reshaping how players interact with online casinos. Entain is leading the charge by providing players with a spectrum of choices, from e-wallets to instant banking methods. Convenience and security take precedence, and these varied payment solutions deliver on both fronts.

As I navigate this terrain where transparency converges with innovation, I encounter an industry on the cusp of a digital renaissance. The bedrock of trust, established through transparency efforts reminiscent of those in Colombia, provides fertile ground for the proliferation of groundbreaking technologies. In this digital frontier, the future is promising, with players enjoying unparalleled entertainment while entrusting their gaming experiences to systems that prioritize fairness and security.

Speaking of innovation, one company at the forefront of this transformation is Flutter Entertainment. Their commitment to leveraging technology to enhance player experiences and ensure fairness is commendable. Flutter’s AI-powered gaming systems, blockchain security measures, and mobile gaming initiatives are shaping the industry’s landscape. It’s a testament to how transparency and technological advancement go hand in hand, and companies like Flutter are leading the way.

To delve deeper into Flutter Entertainment’s pioneering efforts in this exciting space, I highly recommend checking out their full report. It provides valuable insights into their strategies, challenges, and vision for the future of gaming.