Investment Attractiveness: Factors Attracting Investors and Tips for Increasing Project Attractiveness

The Materials section is a rich resource for individuals and organizations with a focus on data.

With thoughtfully curated articles, timely data releases, and a store stocked with ready-to-use data sets, this section caters to your data needs, empowering you to succeed in the dynamic world of data.

Our company information section provides comprehensive information about our services, pricing, team information, and contact details.

We aim to provide our visitors with all the information they need to make informed decisions about our services and build a strong relationship with our team.

In the world of business and finance, investments are an integral part of successful development and achieving financial prosperity, especially in the entertainment and gaming industries. However, in order to attract the attention of investors, a project in the gaming industry must have not only fascinating content but also strong investment attractiveness. Investors seek to discover promising projects that promise high returns and minimal risks.

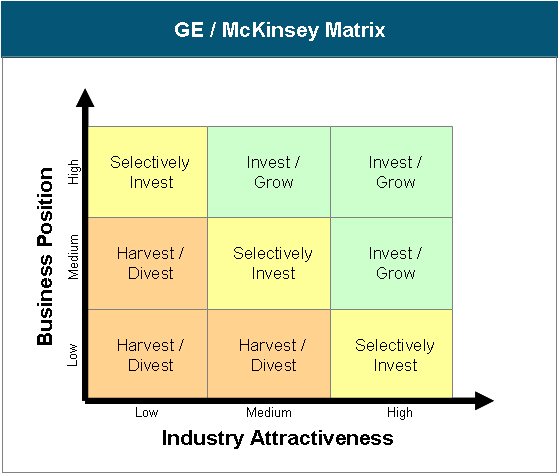

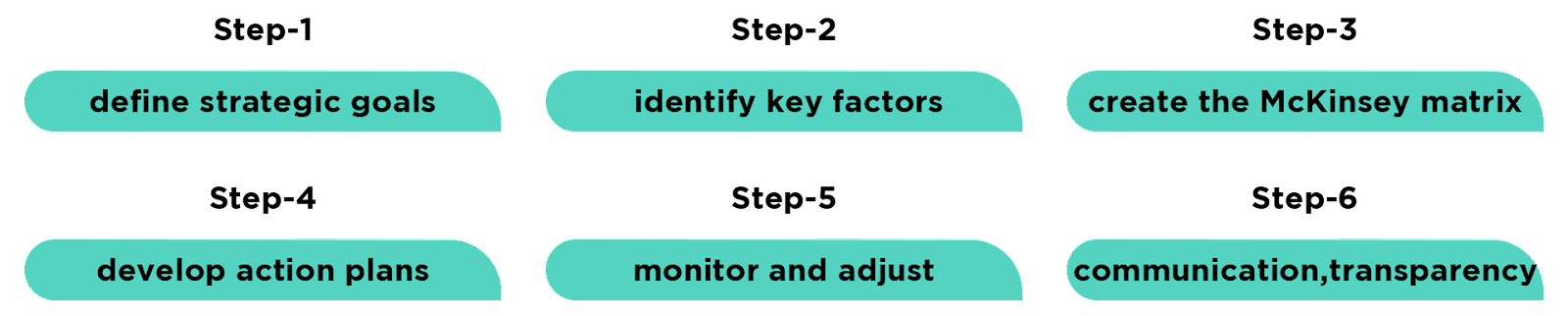

In 2023, the game development industry is shaped by rapidly evolving trends and demands. To enhance investment attractiveness for a game development company, a strategic approach that aligns with the current market landscape is crucial. One effective tool to guide this approach is the McKinsey Matrix (Figure 1). This matrix provides a structured framework for setting strategic goals and identifying key factors for success. Let’s delve into how to increase the investment attractiveness of your game development company using the McKinsey Matrix:

Start by clearly defining the overarching goal – enhancing investment attractiveness. This involves securing funding for expansion, innovation, or new game development projects. Understanding your company’s specific objectives sets the foundation for a targeted strategy.

Market Growth Rate

Assess the potential growth of the game industry. Consider emerging technologies such as virtual reality (VR), augmented reality (AR), and cloud gaming. Also, evaluate new platforms like mobile, consoles, and PC gaming. Stay attuned to evolving player behavior trends.

Competitive Positioning

Evaluate your company’s position relative to competitors. Identify your unique selling points (USPs), strengths, weaknesses, and areas for improvement. A thorough understanding of your market positioning informs your strategic decisions.

Utilizing the insights from Steps 1 and 2, create the McKinsey Matrix to categorize strategic goals into four quadrants:

High Growth and Attractive Investment (Invest and Grow)

Here the goal is to invest heavily and strategically. Possible actions could be:

High Growth but Less Attractive Investment (Harvest or Divest)

In this quadrant, the focus is on maximizing short-term returns and consideration of potential exit strategies. Possible actions include:

Low Growth but Attractive Investment (Invest and Optimize)

Here, the focus is on optimizing existing resources and expanding profitability. Possible actions include:

Low Growth and Less Attractive Investment (Harvest or Divest)

In this quadrant, careful consideration is given to cost containment and potential exits. Possible actions include:

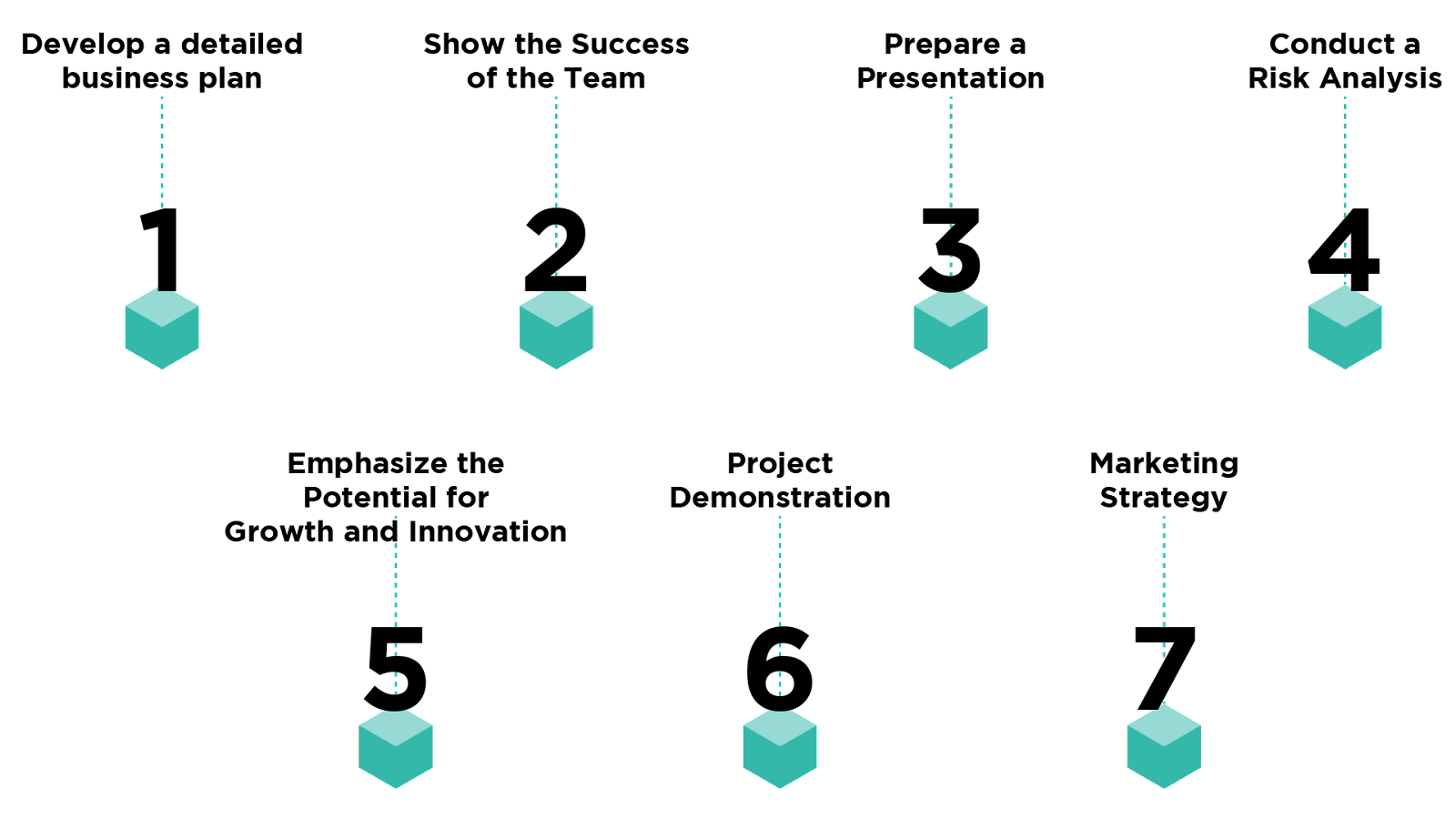

For each quadrant, develop actionable plans aligned with your strategic goals. Ensure these plans are detailed, measurable, and time-bound. Tailor them to your company’s resources and capabilities. Below you can find some tips for increasing the investment attractiveness.

Tips for Increasing Investment Attractiveness

Continuously monitor the progress of your action plans, collecting data on key performance indicators (KPIs). Be prepared to adjust your plans based on shifts in the market landscape and evolving investor expectations.

Maintain open communication with potential investors throughout the process. Clearly communicate your company’s strategic direction, goals, and the steps being taken to enhance investment attractiveness. Transparency and a well-defined vision instill confidence in potential investors.

Remember, the gaming industry is dynamic and subject to rapid changes. The strategic approach outlined above, utilizing the McKinsey Matrix, should remain flexible and adaptable to capitalize on emerging opportunities and address challenges as they arise. By following this method, your game development company can increase its investment attractiveness and improve its chances of securing the funding needed for growth and innovation.

In the world of business and finance, investments are an integral part of successful development and achieving financial prosperity, especially in the entertainment and gaming industries. However, in order to […]

The gaming industry has undoubtedly become a significant sector in the modern world. In 2023, every person has the opportunity to play any game they like on their own computer […]

Gaming industry ETFs invest in companies that generate revenue from the casino sector, video game industry or other forms of entertainment.

Venture capital involves the provision of funding, technical guidance, or managerial support by investors to startups that demonstrate potential for sustained growth.

While various offline activities such as SEO, PPC, media, and exhibitions attract clients and should be part of the bigger strategy, affiliate marketing outperforms them in terms of investments and outcomes.

The importance of intellectual property (IP) in the gaming industry is crucial as it provides legal protection for the unique and creative elements of video games, such as software, music, art, and characters.