Gaming Industry ETF: Definition & Explanation

Gaming Industry Exchange-Traded Funds – Definition

Gaming ETFs allow investors to diversify their holdings within the gaming sector without having to pick individual stocks, thereby spreading the risk across different companies. These ETFs can vary based on their focus: some may target companies involved in the development and publishing of video games, while others might expand their scope to include esports organizations, streaming platforms, and hardware manufacturers.

An example of a gaming ETF is the VanEck Video Gaming and eSports ETF (ESPO), which focuses on companies involved in video game development, esports, and related hardware.

Another example is the Global X Video Games & Esports ETF (HERO), which targets companies from around the globe that are actively involved in the video game and esports industry.

The main difference between these types of gaming industry ETFs lies in their specific investment focus and geographical coverage, offering investors various options based on their market preference and risk tolerance.

Gaming Industry in Numbers: ETF Market Cap of 2022

While we were collecting the data we noticed some things must be known in order to get deeper in the topic:

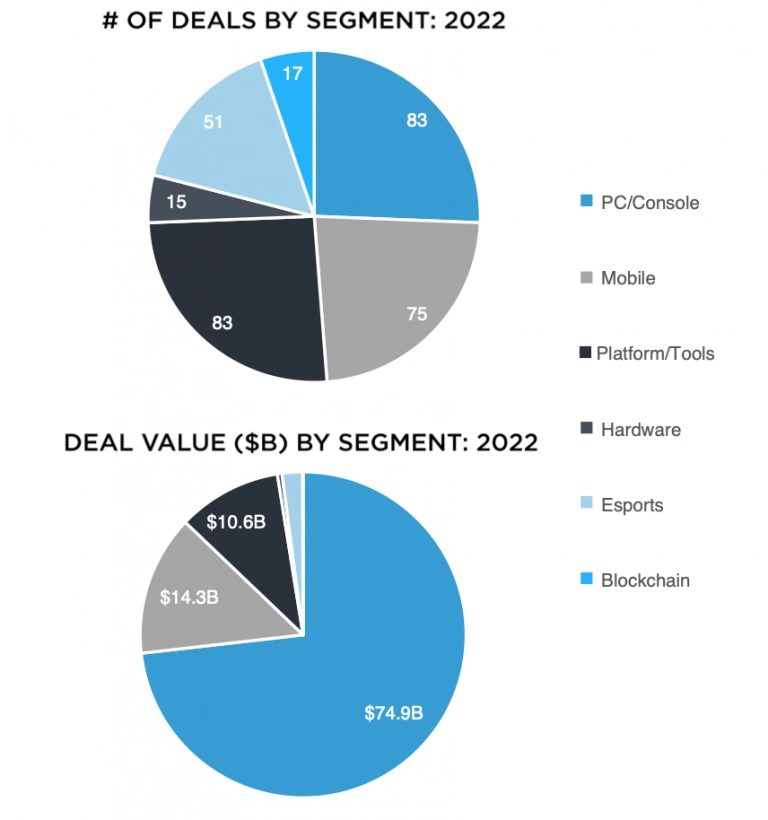

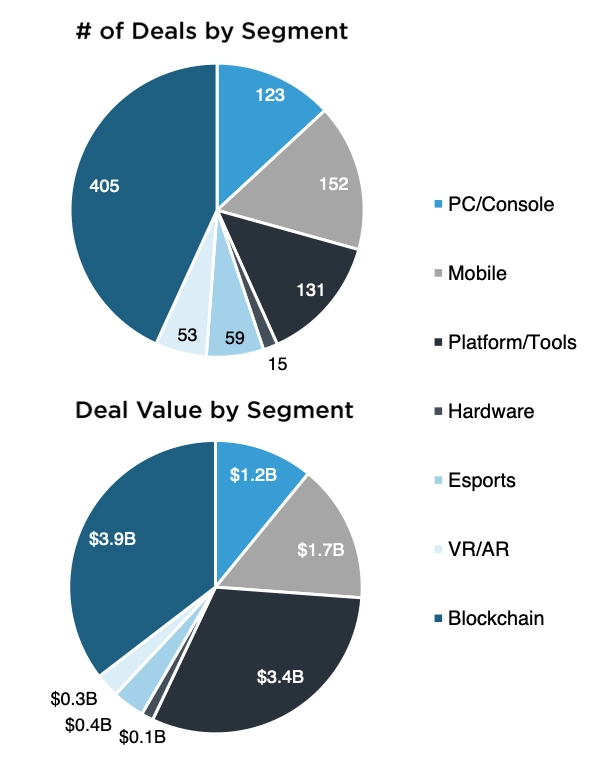

- PC/Console segment emerged as a dominant force, boasting the highest number of deals and a substantial deal value of $74.9 billion. This highlights the enduring popularity and robust demand for gaming experiences on traditional gaming platforms;

- While the Blockchain segment showed promise with a high number of deals (405 deals), its deal value of $3.9 billion indicated that the technology is still in the nascent stages of widespread adoption and investment;

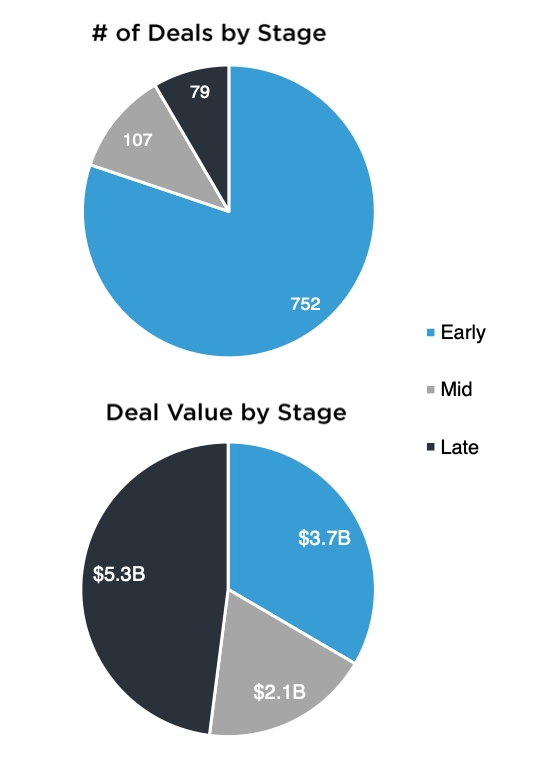

- Early-stage investments (752 deals) took center stage, underlining the industry’s thriving startup ecosystem and the willingness of investors to nurture innovative ideas;

- Platform/Tools segment garnered significant attention, with 131 deals and a deal value of $10.6 billion. This signifies a growing focus on technologies and tools that support and drive the growth of other companies within the industry;

- Hardware, Esports, and VR/AR segments exhibited lower deal values, suggesting potential challenges in attracting substantial investments.

Also, there were 938 deals valued at $11.B in private placements. The distribution of deals across different funding stages provides insights into the investment landscape. The majority of deals are in the early stage (752 deals), indicating a vibrant startup ecosystem and investor interest in nurturing promising ideas. However, the number of deals gradually decreases as the funding stages progress, with mid-stage (107 deals) and late-stage (79 deals) investments being relatively fewer but indicating a focus on maturing companies.

The total deal value for each segment reveals significant variations in investment attractiveness. Mobile, with a deal value of $1.7 billion, also commands considerable attention, reflecting the continued growth of the mobile app and gaming industry. On the other hand, hardware, esports, and VR/AR segments show relatively lower deal values, indicating potential challenges in attracting higher investment.

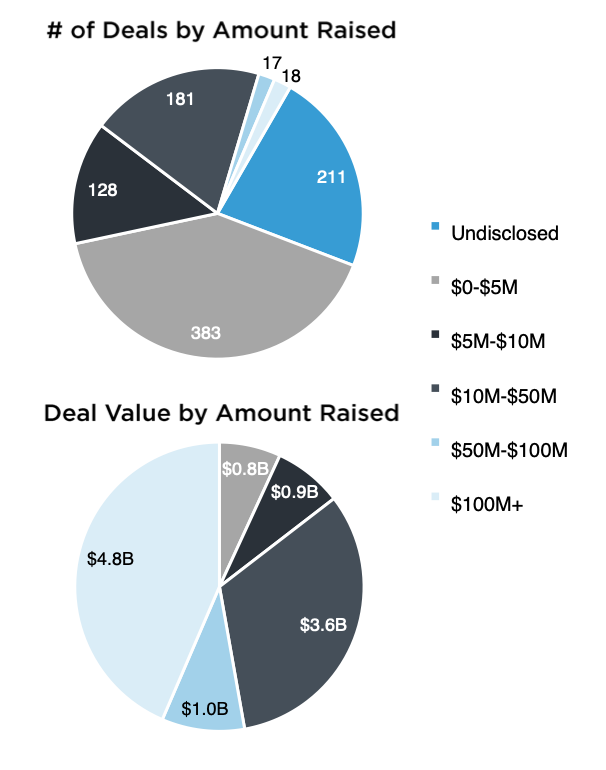

The data on deals based on the amount raised provides insights into the financing needs of different companies. The highest number of deals falls within the $0-$5M range (383 deals), reflecting the prevalence of seed and early-stage investments in the industry. However, the data shows a decline in the number of deals as the investment amount increases, indicating that companies seeking larger funding rounds face a more competitive landscape.

The total deal value for each range of the amount disclosed further reinforces the significance of early-stage investments. While the $100M+ category attracts the highest deal value ($4.8 billion), it represents only 18 deals, indicating larger investments are rarer but substantial when they occur.

The data highlights a strong interest in the Platform/Tools segment, with 131 deals and a deal value of $10.6 billion. This suggests investors’ focus on technologies and tools that facilitate the growth and development of other companies in the industry.

Benefits of a Gaming Indsutry ETF

- Diversification: By investing in a range of companies within the iGaming and gambling sector, ETFs reduce the risk associated with individual stock performance. This diversification helps mitigate sector-specific downturns and volatility, offering a more stable investment vehicle.

- Growth Potential: The iGaming and gambling industry is on an upward trajectory, fueled by technological advancements, regulatory changes, and an increasing number of consumers engaging in online gambling. ETFs offer investors a share in this growth potential without the need to pick individual winners.

- Cost-Efficiency: ETFs generally come with lower expense ratios compared to actively managed funds. This cost efficiency makes them an attractive option for investors looking to maximize returns without incurring high management fees.

- Liquidity: Gaming industry ETFs are traded on major stock exchanges, ensuring high liquidity. This means investors can buy or sell shares with ease, providing flexibility and accessibility to capitalize on market movements.

- Exposure to Innovation: Investing in ETFs focused on the gaming industry offers exposure to companies at the forefront of innovation in online gambling, eSports, and gaming technology, sectors that are expected to drive future industry growth.

By encapsulating the fast-paced evolution and diversification of the iGaming and gambling sector, Gaming industry ETFs represent a promising investment avenue for those looking to leverage the sector’s dynamic growth while managing risk through diversification.

How Do You Invest in Gaming Industry ETF?

Investing in a Gaming ETF (Exchange Traded Fund) offers a convenient way to gain exposure to the gaming and gambling industry, encapsulating sectors from online casinos to video game development. Here’s a step-by-step guide on how to do it:

- Research Gaming ETFs: Start by identifying ETFs that focus on the gaming and gambling industry. Look for ETFs with a good mix of companies involved in various aspects of gaming, including software, hardware, and online gambling.

- Evaluate Performance and Fees: Compare the performance history, expense ratios, and management fees of the ETFs you’re interested in. It’s crucial to consider how these factors may affect your investment returns.

- Choose a Brokerage: Select a brokerage that aligns with your investment style and preferences. Consider factors such as trading fees, platform ease of use, and the availability of research tools.

- Open a Brokerage Account: If you don’t already have one, open an account with your chosen brokerage. This will typically involve filling out an application and providing some personal and financial information.

- Fund Your Account: Deposit funds into your brokerage account. This can usually be done via bank transfer, check, or wire transfer.

- Purchase the ETF: Once your account is funded, search for the Gaming ETF you’ve chosen and place an order. Decide on the number of shares you want to buy and whether to place a market or limit order.

- Monitor Your Investment: Keep an eye on your ETF’s performance and the broader gaming industry. Be prepared to adjust your investment strategy as the market changes.

By following these steps, you can diversify your portfolio and tap into the growth potential of the gaming and gambling sectors through a Gaming ETF.