The Problem of Unit Economy When Using Complex Tariff Schemes

The Materials section is a rich resource for individuals and organizations with a focus on data.

With thoughtfully curated articles, timely data releases, and a store stocked with ready-to-use data sets, this section caters to your data needs, empowering you to succeed in the dynamic world of data.

Our company information section provides comprehensive information about our services, pricing, team information, and contact details.

We aim to provide our visitors with all the information they need to make informed decisions about our services and build a strong relationship with our team.

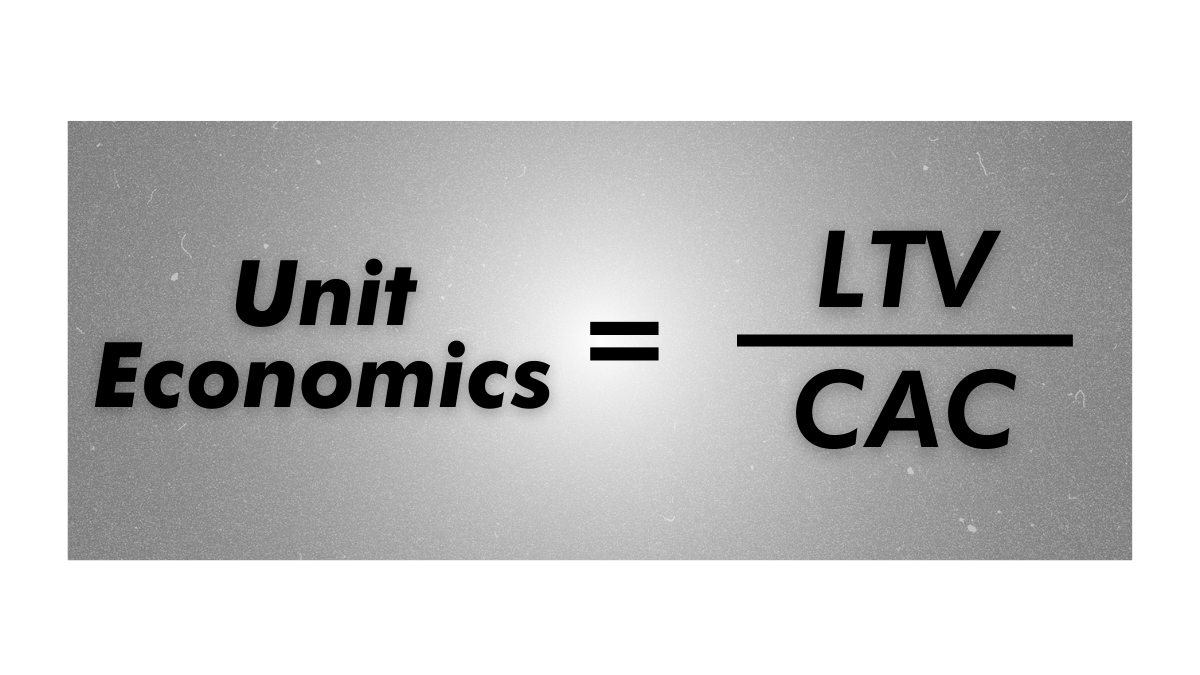

Unit economics is a method of economic analysis that helps determine the profitability of a single unit. Simply put, unit economics shows how much a company earns, will earn, or may lose in the future from one product or customer.

A unit, in this context, is a single item of goods or services. This can be a customer, a subscription, or a website visitor. Typically, the unit is something the company plans to scale in the future. It helps to understand how much money the operator will spend on each customer.

For example:

An online gaming platform has been operating for 5 years and notices that the amount of money in the company is not increasing year over year. They then calculate the unit economics for their users and check how often players return and how much revenue one client brings to the company.

Let’s say the platform finds out that the average cost of acquiring a new player (CAC, Customer Acquisition Cost) is $20. At the same time, the Lifetime Value (LTV) of a customer is $15. This means the platform loses $5 on each new player.

As a result, the platform representatives see that the costs of acquiring new players are higher than the Lifetime Value (LTV) of a customer and can now address the situation. For example, they can send promo codes to users to retain those who have already been acquired or improve player retention through bonuses and promotions. They can also review their marketing strategies to lower the cost of acquiring new players to a level below the LTV. Now, if the platform can reduce the CAC to $10, they will earn $5 for each new player instead of losing money.

There are a lot of formulas of how to calculate unit economy the cost of each customer or group of customers.

Formula: CAC = Total Marketing Expenses / Number of New Customers Acquired

Example: If a company spends $20,000 on affiliate marketing and acquires 1,000 new players, the CAC is $20.

Formula: LTV = Average Revenue per User (ARPU) * Customer Lifetime

Example: If an average player spends $100 over their lifetime on the platform, the LTV is $100.

Formula: Profit per Customer = LTV – CAC

Example: If the LTV is $100 and the CAC is $20, the profit per customer is $80.

Issue: If the CAC is higher than the LTV, the company loses money on each new customer.

Example: Suppose the CAC rises to $120 due to increased affiliate commission rates, while the LTV remains $100. The company now loses $20 per customer.

Issue: If the LTV is too low, even a moderate CAC can lead to losses.

Example: If changes in game quality or competition reduce the LTV to $50, and the CAC is $60, the company loses $10 per customer.

Issue: Over-reliance on affiliates without monitoring performance can lead to high CAC and low LTV.

Example: Affiliates may attract low-quality players who don’t spend much or churn quickly. If the average spend drops to $30, and the CAC is still $60, the company loses $30 per customer.

Issue: Poor retention strategies can decrease the customer lifetime, reducing LTV.

Example: If the average customer lifetime drops from 2 years to 1 year, the LTV might fall from $100 to $50, making the $60 CAC unsustainable.

Issue: Not all customers are equally valuable. Failure to target high-value segments can inflate CAC without corresponding increases in LTV.

Example: Targeting casual players with high CAC affiliates can result in a low LTV of $40, while high-value segments might have an LTV of $150.

Based on the above formulas and calculations, we see that ignoring the analysis of the cost of advertising and income from each player can lead the company to losses. For these reasons, those who thoughtlessly turn to affiliate marketing risk losing a lot of money. But how can this be avoided? Let’s look at some practical tips:

Monitor and Optimize CAC: Monitoring and optimizing Customer Acquisition Cost (CAC) is crucial for maintaining profitability in the iGaming niche. Regularly reviewing affiliate performance and commission structures can help identify the most cost-effective partners. By analyzing which affiliates bring in high-quality players and negotiating better rates with these top-performing affiliates, businesses can lower their CAC. This ensures that the cost of acquiring new customers does not exceed their potential revenue, keeping the unit economy balanced and sustainable.

Increase LTV: Increasing the Lifetime Value (LTV) of customers is another vital strategy. Enhancing the gaming experience can encourage players to spend more over time, thus boosting their overall value to the business. Implementing loyalty programs can also significantly extend the customer lifetime by rewarding repeat engagement and fostering a sense of community and commitment. These initiatives not only increase the revenue per customer but also build a loyal user base that can sustain the business in the long term.

Segment Customers: Effective customer segmentation allows businesses to focus their efforts where they will be most profitable. By using data analytics to identify high-value customers, companies can tailor their marketing strategies to attract and retain these lucrative segments. This targeted approach ensures that marketing resources are spent efficiently, increasing the overall LTV and reducing unnecessary CAC. Focusing on segments with the highest LTV maximizes the return on investment for marketing expenditures.

By understanding and managing unit economy, iGaming businesses can avoid the pitfalls of high CAC and low LTV. Regularly analyzing these metrics and adjusting strategies accordingly can ensure sustainable growth and profitability, preventing bankruptcy.

After the downturn of 2022–2023, the Play-to-Earn (P2E) segment is entering a new phase of development. While the first wave was driven by rapid token growth and speculative activity, by […]

Web3 games have evolved from being new and largely speculative projects focused on short-term earnings to more mature ecosystems, where blockchain serves both as a financial incentive and as a […]

In the world of Web3 games, the idea of Play-to-Earn has long been perceived as a revolution: players could receive real tokens for in-game activity. In practice, it has become […]

While many Web3 projects remain stuck in a perpetual alpha or beta phase for years, Korean gaming companies continue to regularly release large-scale MMORPGs, relying on well-established development processes and […]

Many modern Web3 projects, especially metaverses and blockchain games, remain in beta testing for years: the team publishes frequent status reports, releases regular updates, promises major releases, yet a full-scale […]

The gaming industry is a form of mass culture, where players have a wide range of abilities. Accessibility is not a “checkbox feature” but a fundamental part of product design: […]