7 Biggest Problems with Blockchain Technology

The blockchain is a type of digital ledger that operates in a decentralized manner and is used to record transactions across a network of computers. This innovative technology has caught the attention of regulators due to its potential to benefit various industries. However, as blockchain technology is still in its early stages of development, there are a number of challenges that need to be addressed in order to fully realize its potential.

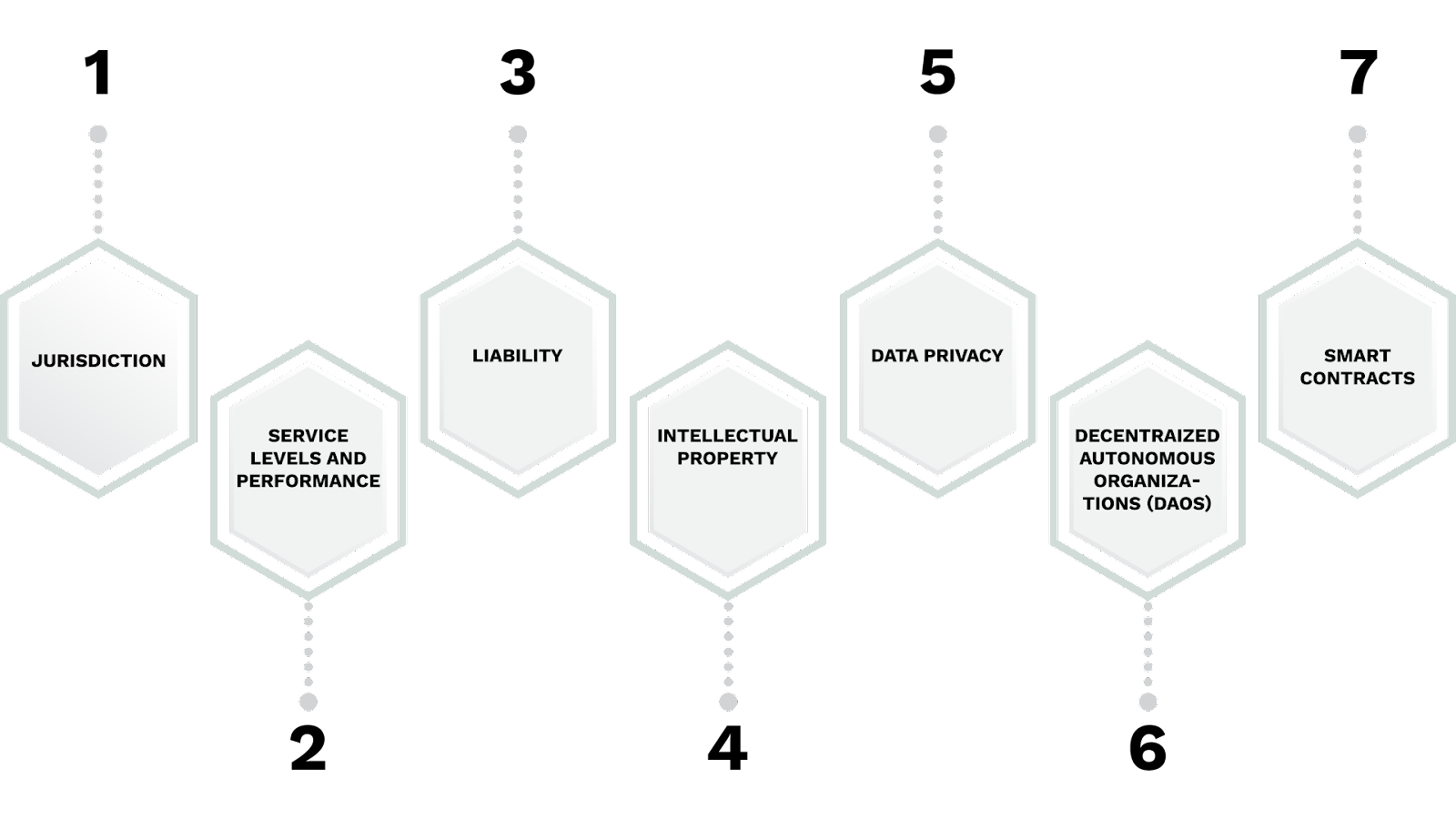

In the context of blockchain technology, there are several legal issues that need to be addressed. These include:

Jurisdiction

Due to the decentralized nature of blockchain, determining the appropriate governing law can be difficult, and issues may arise due to differences in contract and title laws across jurisdictions.

Service levels and performance

Customers may not receive performance guarantees from vendors, which could result in unreliable and unsatisfactory services.

Liability

Customers face risks associated with trading infrastructure issues, such as those related to security and confidentiality, which could lead to systemic problems with the blockchain.

Intellectual property

Ownership of intellectual property within the blockchain is an important consideration, especially when additional developments or solutions are added to meet a customer’s specific requirements.

Data privacy

The transparency of blockchain transactions may conflict with banking sector privacy needs. To address this, limiting network access and encrypting data on the blockchain are potential solutions.

Decentralized Autonomous Organizations (DAOs)

Legal issues related to governance, regulation, and liability arise with DAOs, as there is no central authority overseeing their operations.

Smart Contracts

Enforceability of smart contracts in different jurisdictions is an unresolved issue, and it is unclear how courts will handle disputes related to smart contract performance.

These issues serve as only a small selection of the legal challenges that may arise in relation to blockchain technology. As the technology advances, it is probable that additional legal concerns will arise. Therefore, thoughtful examination of the legal ramifications is crucial to fully capitalize on the advantages of blockchain while minimizing risks.

Blockchain Regulators

Regulators are responsible for enforcing rules and regulations that help regulate different industries in the market. In the case of blockchain technology, regulators play a crucial role in ensuring its safety and stability. To provide flexibility for different blockchain systems, regulators should consider adopting general principles instead of strict rules. Additionally, in certain regions, regulators can promote innovation by offering clear guidelines to new players entering the industry.

These are some common regulations and guidelines that relate to the use of cryptocurrencies:

- Anti-money laundering (AML) regulations: To prevent the use of cryptocurrency for illegal activities such as money laundering, terrorism financing, and other illicit purposes, most countries have AML laws in place. These regulations often require exchanges, wallets, and other crypto-related businesses to verify the identity of their users and report suspicious transactions to the authorities.

- Know Your Customer (KYC) requirements: To prevent fraud, protect consumers, and combat money laundering, many countries have KYC regulations in place. These regulations require exchanges and other crypto-related businesses to collect and verify the personal information of their users.

- Security requirements: To protect the assets of their users, exchanges, wallets, and other crypto-related businesses must implement robust security measures such as two-factor authentication, encryption, and regular backups.

- Taxation requirements: The taxation of cryptocurrencies varies depending on the country and the type of transaction involved. Cryptocurrencies are treated as assets in some countries, and gains from the sale of cryptocurrencies are subject to capital gains tax, while in others, they are considered to be currency and are subject to income tax or value-added tax.

- Licensing requirements: Some countries require exchanges, wallets, and other crypto-related businesses to obtain a license to operate, which may come with specific requirements such as capitalization requirements, business plan submissions, and ongoing reporting obligations.

Over the last ten years, blockchain technology has become increasingly popular due to its decentralized and transparent properties, which have created new possibilities across different sectors, such as finance, supply chain management, and digital identity. Nevertheless, with the rise of blockchain innovations, there is a need for regulatory supervision to ensure that these systems are secure and stable.

Blockchain technology has become increasingly popular in recent years due to its decentralized and transparent nature, resulting in new opportunities across various sectors such as finance, supply chain management, and digital identity. However, with the emergence of blockchain-based innovations, there is a growing need for regulatory oversight to ensure the safety and stability of these systems.

Numerous institutions worldwide have undertaken the task of regulating blockchain technology, each with their own distinct approach and focus. Some of the most prominent institutions include the Securities and Exchange Commission (SEC) in the US, responsible for enforcing securities laws and safeguarding investors, particularly in regulating initial coin offerings (ICOs) and other token offerings. The Financial Conduct Authority (FCA) in the UK, which oversees financial markets and consumer protection, has also taken a proactive stance in regulating blockchain technology and issued guidance on the use of cryptocurrencies and token offerings.

Central banks in various countries, such as the European Central Bank and the People’s Bank of China, are monitoring the development of blockchain technology and its potential impact on the financial system. While some central banks are exploring the use of blockchain technology for their own operations, others are taking a more cautious approach. The Ministry of Finance in several countries is responsible for implementing financial policies and regulations, and is often involved in the regulation of blockchain technology.

Additionally, many countries have national regulatory authorities responsible for specific industries, such as telecommunications or energy, which may also play a role in the regulation of blockchain technology in their respective sectors. Finally, the Internal Revenue Service (IRS) in the US treats cryptocurrencies as property for tax purposes, requiring their reporting on tax returns, with capital gains tax applied to profits from the sale or exchange of cryptocurrencies.

As blockchain technology continues to evolve, regulatory bodies will need to remain vigilant and adapt to ensure the safety and stability of these innovative systems.

The regulatory approach to blockchain technology can vary depending on the jurisdiction and industry in question. Different approaches include:

- Light-touch regulation: A permissive approach that allows for innovation and growth in the blockchain industry while still protecting consumers. It aims to balance the benefits of blockchain technology with the need to address potential risks, such as money laundering and fraud.

- Sandbox approach: A regulatory framework that permits experimentation and testing of blockchain-based products and services in a controlled environment. Companies can test their products and services with a limited user base while still being subject to some regulatory oversight.

- Restrictive regulation: A conservative approach that places strict controls on the use of blockchain technology to minimize risk to consumers. It is typically used in high-risk industries such as finance and healthcare to ensure that the use of blockchain technology does not pose a threat to consumers or the public.

- Pro-innovation regulation: An approach that aims to promote innovation and growth in the blockchain industry while still protecting consumers. It seeks to create a supportive environment for blockchain companies while ensuring that the use of blockchain technology does not pose a threat to consumers or the public.

- Hybrid approach: A regulatory approach that combines elements of multiple approaches to find the right balance between innovation, growth, and protection. It aims to address the unique challenges and risks posed by blockchain technology while still enabling companies to pursue new and innovative use cases.

In general, the regulation of blockchain technology will differ depending on the location, the intended use, and the objectives of the regulators. Nevertheless, it is evident that regulatory bodies will have a significant impact on the development of this dynamic and rapidly changing technology.