Sony Group Corporation, headquartered in Minato, Tokyo, is a prominent Japanese conglomerate renowned for its diverse portfolio encompassing electronics, gaming, entertainment, and financial services. As the company navigates an increasingly competitive global landscape, its strategic focus on creativity, technological innovation, and synergy across its business segments has positioned it for sustainable growth. This analysis delves into Sony’s fiscal year 2023 (FY23) performance, examining revenue dynamics, strategic initiatives, and future prospects.

FY23 Financial Performance Overview

In FY23, Sony reported impressive revenue growth, totaling 13,020,768 million JPY, a remarkable 18.65% increase compared to 10,974,373 million JPY in FY22. This growth underscores the effectiveness of Sony’s strategy to leverage its diverse business segments and capitalize on market opportunities.

Revenue Breakdown by Segment

The revenue distribution highlights the significant contributions from various sectors:

- Game and Network Services: Generating 32.78% of total revenue at 4,267,734 million JPY, this segment remains a cornerstone of Sony’s business, driven by the success of its gaming franchises and network services.

- Entertainment Technology & Services (ET&S): Contributing 18.84% (2,453,718 million JPY), this segment reflects Sony’s commitment to creating cutting-edge technology that enhances entertainment experiences.

- Financial Services: Accounting for 13.59% (1,769,954 million JPY), this segment has shown resilience, bolstered by the company’s strategic focus on financial solutions.

- Music: Contributing 12.43% (1,618,958 million JPY), the music division benefits from Sony’s extensive catalog and growing digital streaming revenues.

- Pictures: At 11.47% (1,493,050 million JPY), the film division continues to evolve, leveraging popular franchises and expanding into new media formats.

- Imaging & Sensing Solutions (I&SS): Representing 12.31% (1,602,738 million JPY), this segment underscores Sony’s leadership in sensor technology, essential for both consumer electronics and automotive applications.

- All Other: Contributing a smaller 0.69% (89,370 million JPY), with adjustments for corporate and eliminations totaling 274,754 million JPY.

Regional Sales Performance

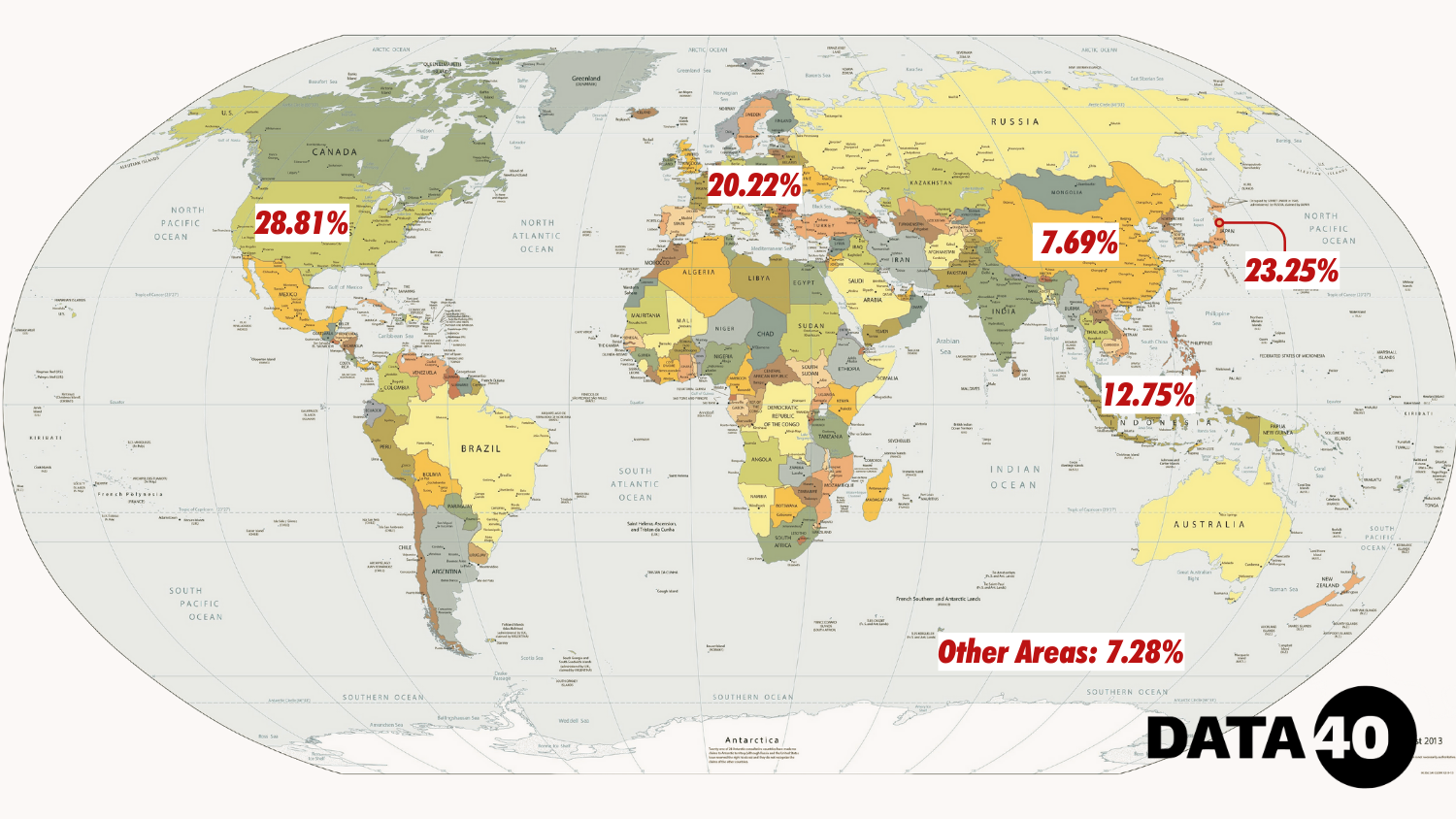

Sony’s revenue by region further illustrates its global reach:

- United States: Leading with 28.81% (3,751,239 million JPY), showcasing the significance of the U.S. market in Sony’s overall strategy.

- Japan: Contributing 23.25% (3,027,526 million JPY), the domestic market remains crucial for sustaining growth.

- Europe: Accounting for 20.22% (2,632,963 million JPY), indicating strong performance across various European markets.

- Asia-Pacific: Contributing 12.75% (1,659,776 million JPY), this region is vital for expansion, particularly in emerging markets.

- China: Representing 7.69% (1,000,907 million JPY), reflecting the challenges and opportunities present in one of the world’s largest markets.

- Other Areas: Contributing 7.28% (948,357 million JPY), further diversifying revenue sources.

Strategic Initiatives and Company Vision

Sony’s strategy in FY23 revolved around the “Creative Entertainment Vision,” which emphasizes three key phases:

- Harnessing Technology: Utilizing advanced technologies to enhance creativity and push boundaries across various media formats.

- Connecting Communities: Fostering vibrant communities by bridging diverse values and experiences.

- Creating Exciting Experiences: Collaborating with creators to deliver compelling narratives that resonate globally.

Acceleration of Group Synergies

The reorganization of Sony’s corporate structure in 2021 has led to improved synergy across its entertainment segments—Game & Network Services, Music, and Pictures—accounting for approximately 60% of consolidated sales in FY23. This strategic alignment enhances operational efficiency and innovation.

Maximizing IP Value

Sony has actively pursued initiatives to maximize the value of its intellectual property (IP) across entertainment categories. This includes:

- IP Creation and Cultivation: Investing in the development of original content to strengthen its portfolio.

- IP 360 Extension: Expanding IP beyond traditional boundaries, allowing for cross-platform integration and global appeal.

- Global Expansion: Supporting creators from diverse backgrounds to enhance Sony’s cultural relevance and broaden its reach.

Technology as a Catalyst

Sony’s focus on technology, particularly in CMOS image sensors and real-time creation technologies, underpins its strategy to enhance the quality and efficiency of content creation. With capital expenditures of approximately 1.5 trillion yen over the past six years, the company is positioned to lead in sectors such as imaging and gaming, significantly impacting mobility and safety.

Challenges and Future Prospects

Despite its achievements, Sony faces challenges, including:

- Intense Competition: The entertainment and technology sectors are highly competitive, necessitating continuous innovation and adaptability.

- Global Market Dynamics: Fluctuations in economic conditions and regulatory changes may impact revenue streams across different regions.

Sony Group Corporation has demonstrated resilience and strategic foresight in FY23, achieving significant revenue growth and advancing its commitment to creative excellence. By harnessing technology, maximizing IP value, and fostering diverse talent, Sony is well-equipped to navigate the complexities of the entertainment landscape.

As the company moves forward, its focus on innovation and community engagement will be crucial. With an exciting pipeline of game releases, continued investment in content creation, and a commitment to expanding its global footprint, Sony is poised to remain a leader in the entertainment industry for years to come.

Looking ahead, Sony’s ability to adapt to market shifts while maintaining its core values will be instrumental in driving sustained growth and enhancing shareholder value.