The gambling industry continues to attract the attention of investors around the world. Every day millions of players place their bets in search of luck, and companies in this industry actively compete for their market share. But how to choose the most promising assets for investment?

As an expert in the gambling industry, I understand the complexities and nuances that surround investment decisions in this dynamic field. In the pursuit of success and profitability, investors need to navigate through a vast array of companies, each vying for a leading position in the market. Amidst this whirlwind, one critical factor stands out – liquidity. Liquidity plays a pivotal role in the world of investments, and the gambling industry is no exception. Companies with high liquidity possess the ability to swiftly adapt to changing market conditions, making them more resilient and appealing to investors seeking stability and growth.

Exploring Liquidity in Online Gambling Giants

I invite you to participate in a unique exploration of liquidity in this dynamic sector, which holds tremendous sway over investment strategies. In the world of gambling, where every card can alter your fate, a company’s liquidity stands as a pivotal factor that can determine the success or failure of investments. Companies with high liquidity possess the ability to swiftly adapt to changing market conditions, rendering them more resilient and appealing to investors.

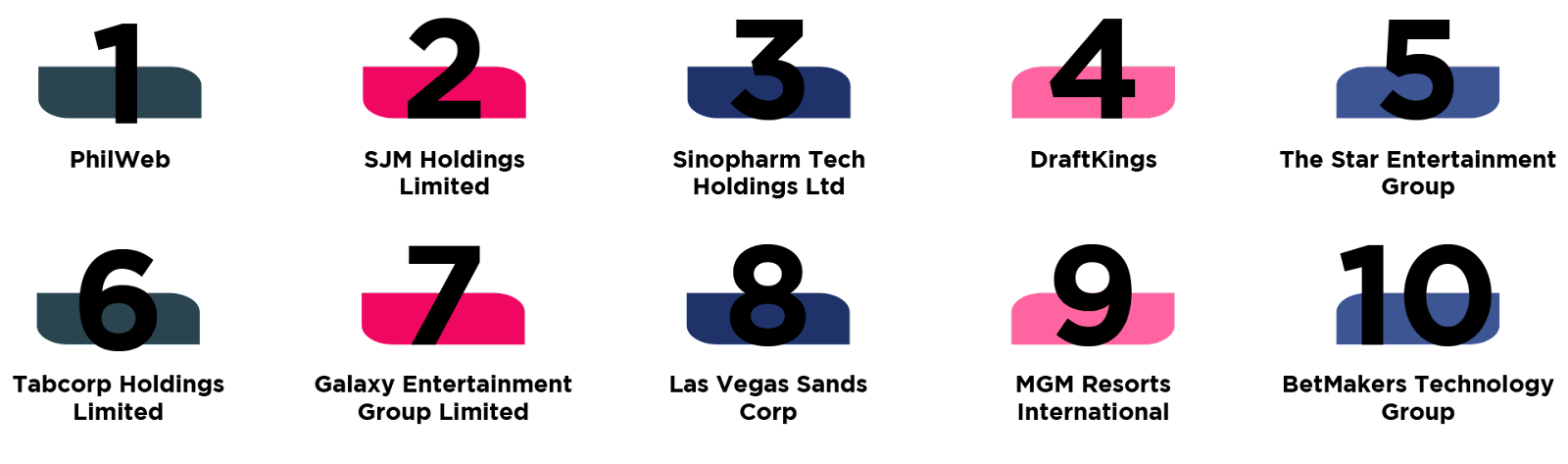

In this article, I will present to you the top 10 most liquid companies in the gambling industry. My analysis is founded on years of experience, extensive market research, and a profound understanding of the factors that influence successful investment.

The information provided above is a concise summary of the ihd 40 Index. This index tracks the price performance of 40 joint stock companies in the iGaming industry, encompassing online gambling activities like casino games, sports betting, poker, bingo, and lottery.

It is maintained by Data 40 Ltd., a data analytics company specializing in gaming, aiming to represent the iGaming industry comprehensively and highlight its growth potential. The index uses a market capitalization-weighted methodology, adjusting semi-annually to reflect market changes and considering companies’ diversification in their iGaming operations:

- PhilWeb

Corporation is a prominent gaming company based in the Philippines. Established in 2000, the company specializes in providing e-gaming solutions and services to various online and land-based gaming operators in the country. One of the significant aspects that set PhilWeb apart is its digital platform that enables gaming operators to offer a diverse range of casino games, such as slots, table games, and lottery products, to their customers. This platform leverages advanced technology and robust security measures to ensure a safe and seamless gaming experience for players.

For PhilWeb Corporation, the number of outstanding shares stands at an impressive 1,435,776,680. As of the latest data available, PhilWeb Corporation boasts an impressive average trading volume of 727,878,914. This robust trading activity reflects the company’s prominence and investor interest in the gaming sector in the Philippines. - SJM Holdings Limited

SJM Holdings Limited – a major player in China’s gambling industry. With 7,040,000,000 outstanding shares and an average trading volume of 18,569,762, it enjoys a strong market presence. Operating in Macau, it offers diverse gaming options and focuses on top-notch experiences. A compelling choice for investors in the booming gambling and entertainment sector. - Sinopharm Tech Holdings Ltd

Sinopharm Tech Holdings Ltd, headquartered in China, is a notable company in the gambling industry. With 4,590,000,000 outstanding shares and an average trading volume of 15,780,000, it commands a significant market presence. As an investor, this company presents an enticing opportunity in the vibrant and dynamic world of gambling and entertainment. - DraftKings

DraftKings, based in the USA, is a prominent player in the gambling industry. With 451,630,000 outstanding shares and an average trading volume of 13,301,832, it showcases a strong market presence. As an investor, this company presents an exciting prospect in the thriving landscape of gambling and entertainment in the United States. - The Star Entertainment Group

The Star Entertainment Group, headquartered in Australia, is a significant player in the gambling industry. Boasting 947,990,000 outstanding shares and an average trading volume of 11,122,637, it holds a robust market presence. For investors seeking opportunities in the Australian gambling and entertainment sector, this company stands out as an appealing option. - Tabcorp Holdings Limited

Tabcorp Holdings Limited, based in Australia, is a prominent player in the gambling industry. With 2,250,000,000 outstanding shares and an average trading volume of 10,659,072, the company demonstrates a substantial market presence. Investors looking for potential prospects in the Australian gambling and entertainment sector may find Tabcorp Holdings Limited an intriguing choice. - Galaxy Entertainment Group Limited

Galaxy Entertainment Group Limited, a major player in China’s gambling industry, possesses 4,360,000,000 outstanding shares and an average trading volume of 9,861,324. With a strong market presence, the company presents an alluring option for investors exploring opportunities in the thriving Chinese gambling and entertainment sector. - Las Vegas Sands Corp

Las Vegas Sands Corp, headquartered in the United States, is a prominent company in the gambling industry. With 763,989,752 outstanding shares and an average trading volume of 4,971,991, the company demonstrates a significant market presence. Investors seeking exposure to the US gambling and entertainment market may find Las Vegas Sands Corp an enticing choice. - MGM Resorts International

MGM Resorts International, a major player based in the USA, boasts 373,913,450 outstanding shares in stock and an average trading volume of 4,265,278. With a solid market presence, this company offers investors a compelling opportunity in the vibrant and dynamic world of the US gambling and entertainment industry. - BetMakers Technology Group

BetMakers Technology Group, headquartered in Australia, is a noteworthy company in the gambling industry. It holds 942,050,000 outstanding shares in stock and experiences an average trading volume of 4,196,605. With a robust market presence, BetMakers Technology Group presents an attractive prospect for investors seeking opportunities in the Australian gambling and technology sector.

Why have these specific companies become so highly liquid and attractive to investors? The answer lies in their ability to effectively cope with challenges and adapt to changes in the gambling industry. These companies possess unique qualities and advantages that account for their attractiveness in the investment market.

Key Reasons Behind Investor Interest in These Gambling сompanies

From groundbreaking innovations and cutting-edge technologies to robust global presence and unwavering commitment to transparency, these companies have mastered the art of staying ahead of the curve. Join us as we unveil the secrets behind their impressive liquidity and explore the compelling reasons that have enticed investors to place their bets on these gambling industry giants.

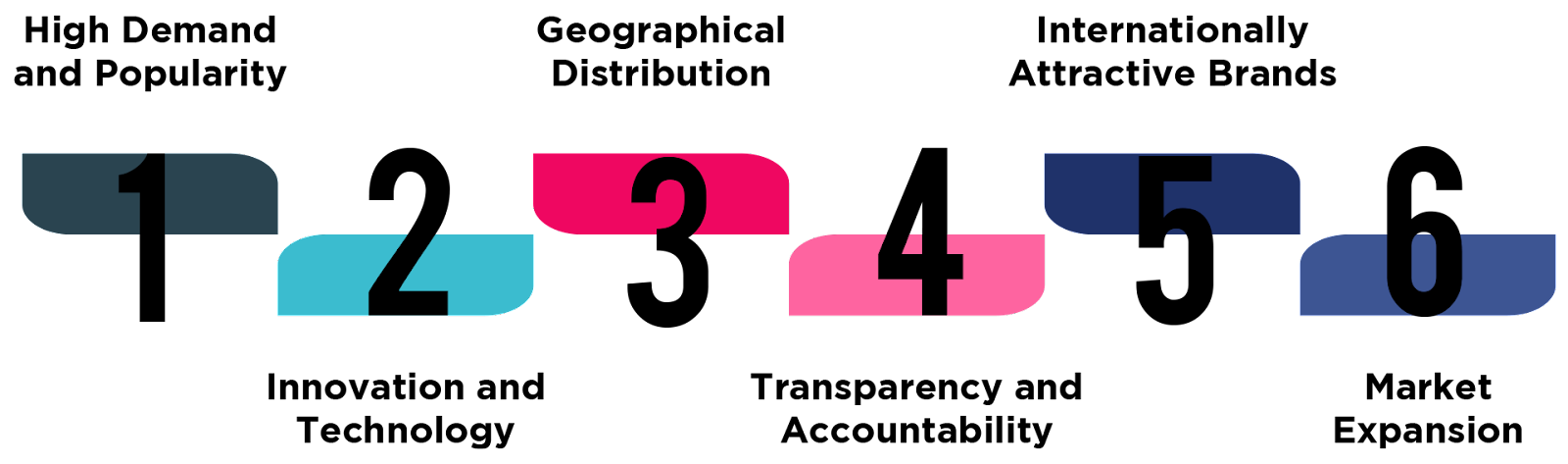

The compelling reasons that have enticed investors to place their bets on these gambling companies:

- High Demand and Popularity:

Companies such as BetMakers Technology Group, MGM Resorts International, and Las Vegas Sands Corp have earned maximum liquidity due to their unique ability to attract a vast number of players. Their exceptional gaming offerings, enticing bonuses, and diverse entertainment options make them unparalleled in the market, sustaining investor interest. - Innovation and Technology:

Companies like Best Makers Technology Group and Galaxy Entertainment Group Limited actively invest in digital technologies and developments, appealing to tech-savvy and forward-oriented customers. The utilization of artificial intelligence, blockchain technologies, and enhanced online platforms contributes to an increased customer base and, consequently, liquidity. - Geographical Distribution:

Companies such as Las Vegas Sands Corp and Galaxy Entertainment Group Limited have an extensive network of casinos and entertainment complexes across various countries, providing them with diverse investors and a stable stock liquidity. - Transparency and Accountability:

Companies like MGM Resorts International emphasize the transparency of their operations and their responsibility to players and investors. This reinforces trust and maintains stock liquidity in the long term. - Internationally Attractive Brands:

Companies like Best Makers Technology Group and MGM Resorts International have established themselves as global brands with appealing reputations and a large fan base. Their popularity and worldwide recognition attract investors from around the globe, ensuring high liquidity and steady stock growth. - Market Expansion:

Companies like BetMakers Technology Group, Las Vegas Sands Corp, and Galaxy Entertainment Group Limited are striving to expand their presence in global markets, which contributes to increased interest from international investors and, consequently, stock liquidity. Thanks to their strategic partnerships, acquisitions, and expansion into various regions, these companies are strengthening their positions in the global gambling market. For instance, BetMakers Technology Group is actively expanding its presence in Asia, Europe, and the USA, aiming to provide global access to its innovative products and solutions.

Las Vegas Sands Corp and Galaxy Entertainment Group Limited are also pioneers in opening luxurious casino resorts in different countries such as China, Singapore, South Korea, and others. This geographical expansion attracts not only local customers but also numerous foreign guests and investors, leading to an increase in the liquidity of the companies’ stocks.

Thus, the drive to expand into global markets makes BetMakers Technology Group, Las Vegas Sands Corp, and Galaxy Entertainment Group Limited some of the most attractive companies for investors seeking maximum liquidity and potential growth in the rapidly developing gambling industry.

In conclusion, after examining the top 10 most liquid companies in the gambling industry, we have discovered that their success is attributed to a variety of factors. Not only do they enjoy high demand and popularity among players, but they also demonstrate active adoption of innovative technologies. Their geographical reach, international brand appeal, as well as transparency and accountability in business operations, bolster investor confidence and sustain steady stock liquidity.

These companies stand at the forefront of the gambling industry, attracting both millions of players and investor attention. Their ability to adapt to rapidly changing market conditions, implement innovations, and offer unique gaming propositions makes them enticing to investors seeking to capitalize on attractive opportunities in this thrilling domain. The future of the gambling industry promises to continue captivating investors, and these industry frontrunners will remain at the forefront, thriving in this unique and high-yielding realm of entertainment and chance.