As we wrote, KYC & KYB have become mandatory components in risk management strategies for many companies worldwide. They help prevent illegal activities such as money laundering and terrorism financing, and also contribute to maintaining the company’s business reputation.

The main goals and objectives of KYC & KYB include:

Fraud prevention:

- Verifying the identity of clients and business partners helps identify potential fraudsters and prevent financial losses.

- Ongoing transaction monitoring helps detect suspicious activities and prevent possible criminal actions.

Compliance with regulatory requirements:

- Companies are required to comply with international and national laws, such as anti-money laundering (AML) and counter-terrorism financing (CTF) laws.

- Non-compliance with these requirements can lead to serious legal consequences, including fines and sanctions.

Protection of the company’s reputation:

- Working with reliable and verified clients and partners helps avoid reputational risks.

- Companies known for their strict compliance policies attract more trust from customers and investors.

Who Needs KYC & KYB Services

Companies and organizations across various sectors require KYC & KYB services to ensure their security and compliance with regulatory requirements. We have compiled a list of companies offering KYC & KYB services. This resource can be useful for many organizations, but we will list only a few of them:

- Banks: Dealing with large sums and numerous clients, banks must rigorously verify their customers to prevent fraud and comply with regulatory requirements.

- Online banking: Internet banks require reliable customer identification systems to ensure user security and trust.

- Credit institutions: These companies often face risks such as credit fraud and client insolvency, making reliable KYC & KYB procedures crucial for their security.

- Insurance companies: Ensuring the honesty and accuracy of client data helps insurance companies prevent insurance fraud and manage risks.

- Payment systems: Transaction security and fraud prevention are paramount for payment systems serving millions of users globally.

- Cryptocurrency exchanges: With increased regulatory scrutiny on cryptocurrency transactions, exchanges must strictly adhere to KYC & KYB procedures to prevent illegal activities.

- Online casinos and gambling platforms: The gambling industry’s customer verification requirements are becoming stricter to prevent fraud, money laundering, and protect underage players.

Centralized lists of KYC & KYB companies help these organizations swiftly and effectively find reliable partners for necessary checks. This enhances security levels, builds trust with clients and partners, and ensures compliance with regulatory requirements.

How It Facilitates Finding a Reliable Partner

We have created a unified list of KYC & KYB companies that offers significant advantages to businesses and organizations in their search for reliable partners. Here’s how this list can streamline the selection process:

Convenience in Search

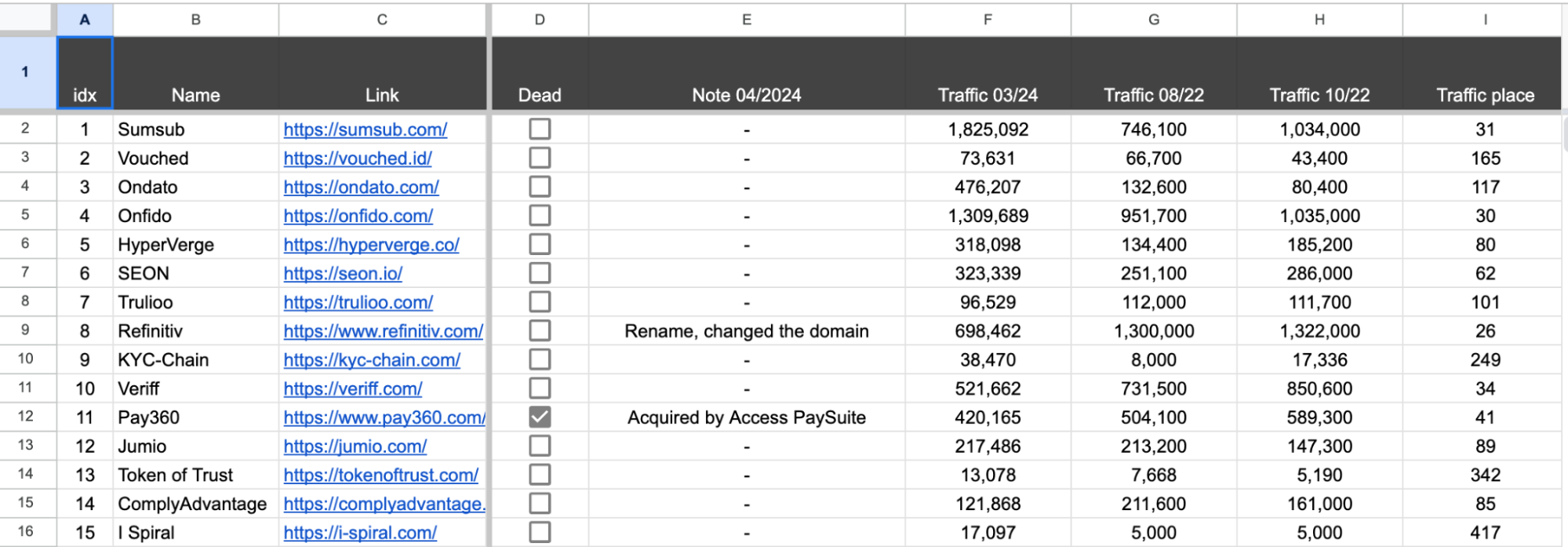

All Companies in One Place: By the fourth quarter of 2022, we compiled 635 companies providing KYC & KYB services. This list enables users to quickly find the necessary companies without spending time on prolonged online searches.

Comparison of Terms and Services: Having 635 companies in one list makes it easier to compare offers, helping to choose the most suitable partner based on individual needs and requirements.

Saving Time and Resources

Reducing Costs for Search and Verification of Potential Partners: Using the ready-made list reduces the time and effort companies spend on searching for and verifying KYC & KYB providers on their own. This allows them to focus on core activities without being distracted by lengthy search procedures.

Relevance

Access to Website Traffic: The list includes traffic data for August 2022, and October 2022, March 2024 allowing an assessment of website activity.

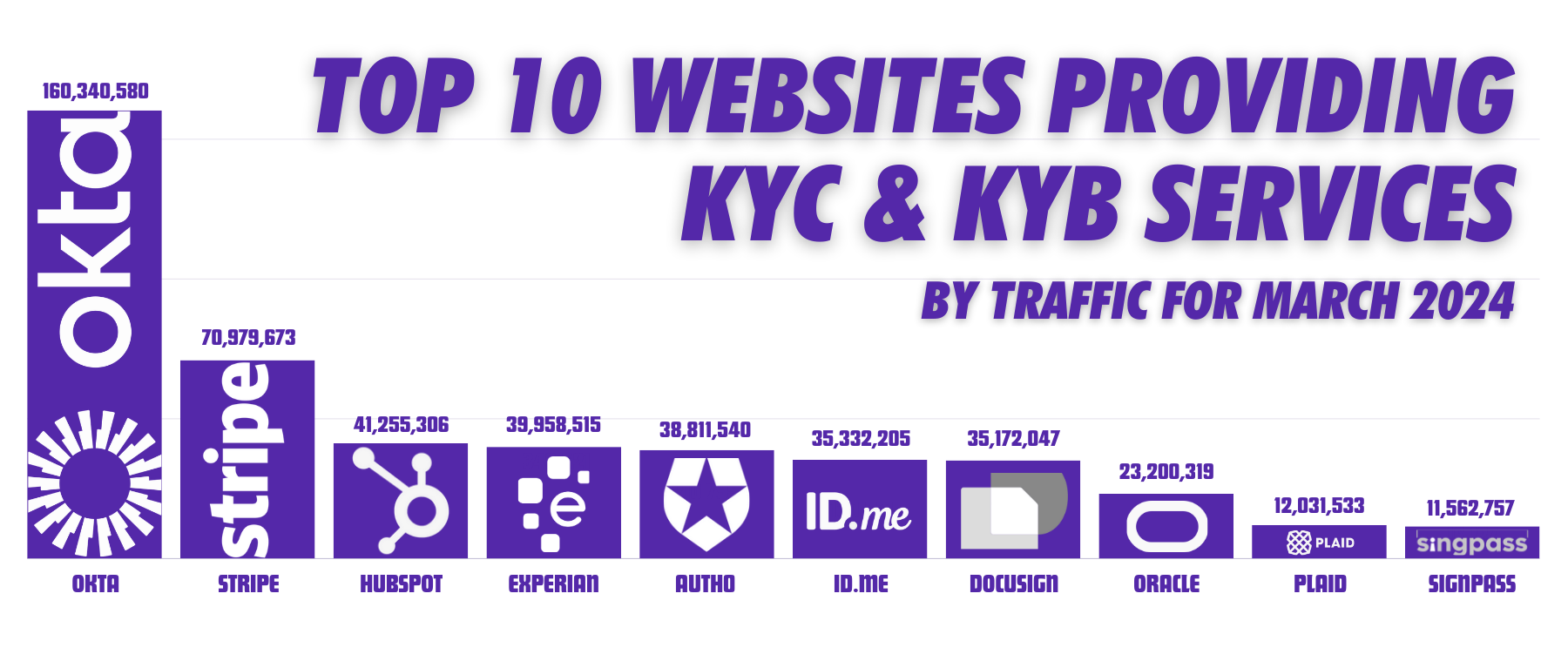

Top 10 websites providing KYC & KYB services by traffic for March 2024:

- Okta – 160,340,580

- Stripe – 70,979,673

- HubSpot – 41,255,306

- Experian – 39,958,515

- Auth0 – 38,811,540

- ID.me – 35,332,205

- DocuSign – 35,172,047

- Oracle – 23,200,319

- Plaid – 12,031,533

- Signpass – 11,562,757

Cost and Time of Verification: The inclusion of the cost of verifying one user and the time spent on verification provides an objective assessment of service quality, contributing to a more informed choice of partner.

Creating and maintaining such a list of KYC & KYB companies represents an important resource for all organizations that need reliable and effective checks on their clients and partners. This not only facilitates the search for suitable providers but also contributes to overall security and compliance with regulatory requirements.

The Importance of KYC & KYB for Your Business

In the context of globalization and increasing regulatory requirements, KYC & KYB procedures are becoming vital for financial institutions, fintech companies, law firms, iGaming, and many other businesses. KYC & KYB are integral parts of risk management strategies. Regular data updates and continuous monitoring of clients and partners help these businesses stay ahead of potential threats and comply with all regulatory requirements.

Given the importance of KYC & KYB for business, using KYC & KYB Providers Q4 2022 becomes a necessary step for finding a reliable partner and ensuring compliance. Use our KYC & KYB company list to simplify the selection process and save time and resources.