How Blockchain is Changing the Game for Startups and Investors

The Materials section is a rich resource for individuals and organizations with a focus on data.

With thoughtfully curated articles, timely data releases, and a store stocked with ready-to-use data sets, this section caters to your data needs, empowering you to succeed in the dynamic world of data.

Our company information section provides comprehensive information about our services, pricing, team information, and contact details.

We aim to provide our visitors with all the information they need to make informed decisions about our services and build a strong relationship with our team.

In the fast-paced world of business and investing, there’s a new player in town that’s changing the rules: Blockchain. You might have heard about it in the context of Bitcoin, but blockchain is more than just digital currency. It’s like a high-tech magic ledger that’s making waves in the world of venture capital (VC), the money that helps new businesses get off the ground.

In a world where innovation is the driving force behind progress, the marriage of blockchain technology and venture capital presents a landscape of unprecedented possibilities. As an entrepreneur who has navigated the turbulent waters of traditional fundraising, I find myself captivated by the transformative potential that blockchain brings to the realm of venture capital.

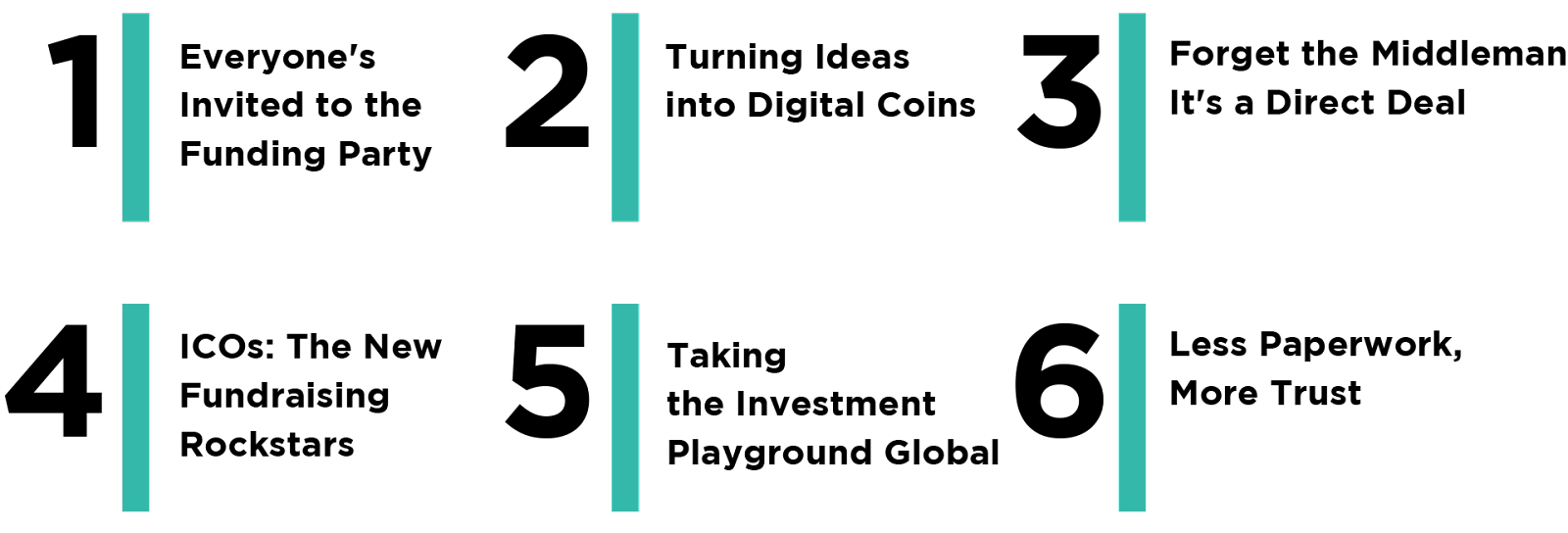

The traditional venture capital model, while successful in many respects, is not without its flaws. It’s a system that often favors the well-connected, leaving many brilliant minds in the shadows due to a lack of access to the right networks. Blockchain, with its decentralized and transparent nature, has the power to level the playing field, opening the gates of venture capital to a global pool of talent.

One of the most exciting aspects of blockchain in venture capital is its ability to facilitate truly borderless transactions. Gone are the days of being confined by geographical constraints or hindered by bureaucratic red tape. Smart contracts, powered by blockchain, have the potential to streamline the investment process, reducing friction and accelerating the speed at which ideas can be funded and brought to fruition.

Moreover, the trustless nature of blockchain introduces a new era of accountability. The immutable and transparent nature of the technology ensures that every transaction is recorded and accessible to all relevant parties. This not only minimizes the risk of fraud but also instills a level of trust that is often elusive in traditional venture capital ecosystems.

As someone who has experienced the challenges of fundraising firsthand, the idea of democratizing access to capital through blockchain is particularly enticing. Initial Coin Offerings (ICOs) and Security Token Offerings (STOs) have emerged as novel ways for entrepreneurs to raise funds directly from a global pool of investors. This not only diversifies the investor base but also allows for a more direct connection between creators and supporters.

It’s important to acknowledge that, like any disruptive technology, blockchain in venture capital is not without its challenges. Regulatory uncertainties, scalability issues, and the need for widespread adoption are hurdles that must be overcome. Yet, as someone who has witnessed the transformative power of technology in reshaping industries, I am optimistic that these challenges will be met with innovation and resilience.

Let’s dive into how this technology is shaking things up and what it means for the future of startups and the folks who invest in them.

For the full potential of blockchain in venture capital to be realized, there’s a need for education and collaboration. Both entrepreneurs and investors need to understand the technology and its implications. Collaboration between industry stakeholders, regulators, and innovators is essential to navigating the evolving landscape and ensuring responsible growth

The integration of blockchain technology into the world of venture capital is a thrilling prospect for entrepreneurs like myself. It holds the promise of a more inclusive, transparent, and efficient ecosystem that empowers innovators from every corner of the globe. While challenges undoubtedly lie ahead, the potential rewards for embracing this paradigm shift are too compelling to ignore. As we stand on the cusp of a new era in venture capital, I am excited to be part of a community that is pushing the boundaries of what is possible, fueled by the transformative force that is blockchain technology.

Blockchain is like a superhero for startups and investors. It’s breaking down barriers, making funding more inclusive, and changing the way we think about investing in the next big thing. The future of venture capital is looking more exciting and accessible than ever, thanks to the magic of blockchain technology. So, get ready to see more startups, big and small, stepping into the spotlight with the support of a global audience. The show is just beginning!

After the downturn of 2022–2023, the Play-to-Earn (P2E) segment is entering a new phase of development. While the first wave was driven by rapid token growth and speculative activity, by […]

Web3 games have evolved from being new and largely speculative projects focused on short-term earnings to more mature ecosystems, where blockchain serves both as a financial incentive and as a […]

In the world of Web3 games, the idea of Play-to-Earn has long been perceived as a revolution: players could receive real tokens for in-game activity. In practice, it has become […]

While many Web3 projects remain stuck in a perpetual alpha or beta phase for years, Korean gaming companies continue to regularly release large-scale MMORPGs, relying on well-established development processes and […]

Many modern Web3 projects, especially metaverses and blockchain games, remain in beta testing for years: the team publishes frequent status reports, releases regular updates, promises major releases, yet a full-scale […]

The gaming industry is a form of mass culture, where players have a wide range of abilities. Accessibility is not a “checkbox feature” but a fundamental part of product design: […]