Everi Holdings Inc., a prominent provider of gaming products and financial technology solutions, is headquartered in Las Vegas, Nevada. The company boasts a rich history in the gaming industry and has established itself as a trusted partner for casinos worldwide. Everi offers a comprehensive suite of gaming content, including electronic gaming machines, table games, and interactive gaming solutions, as well as financial technology services such as cash handling, payment processing, and loyalty programs. The company’s innovative products and services are designed to enhance the player experience, drive operational efficiency, and maximize revenue opportunities for its customers.

Expansion of Everi Holdings Inc into the Australian Gaming Market

In Q1FY22, the company entered the Australian gaming and financial technology market with Atlas Gaming and ecash Holdings Pty Limited.

Everi Holdings Inc’s choice to expand into the Australian gaming market is motivated by several key factors and strategic objectives. For starters, Australia is a profitable market with an increasing demand for innovative gaming solutions. By entering this market, Everi aims to take advantage of emerging opportunities and establish a solid presence in the area. Expanding into Australia aligns with Everi’s broader strategy of diversifying its geographical reach and revenue streams, reducing its dependence on any individual market or segment. Entering the Australian gaming market allows Everi to use its expertise and technology to offer tailored gaming experiences that resonate with local players, enhancing customer satisfaction and loyalty.

Everi recently entered into an agreement to acquire ecash, one of Australia’s leading innovators in payment systems and cash management technology, and upon closing of the transaction, the ecash team will be welcomed into Everi. Randy Taylor, President and Chief Operating Officer of Everi, expressed his excitement, stating, “eCash is a strategic addition to our growing global portfolio and will provide us entry into the large Australian gaming market with an experienced team, proven product portfolio and established customer base. This acquisition will also provide us with an additional customer base in certain U.S. and other gaming markets that we do not currently serve. Everi has never been in a better position as we continue to successfully execute on our strategic growth initiatives.”

This is a significant development for Everi, which opens up new opportunities in the international gambling market. The acquisition of ecash not only strengthens the company’s position in the US, but also provides them with entry into the large Australian market. It gives Everi access to an experienced team, a proven product portfolio and an established customer base that will help them expand their influence and competitiveness.

The Significance of Entering the Australian Fintech Market for Everi Group

Everi Holdings Inc’s expansion into the Australian gaming and fintech market underscores its commitment to global growth and diversification. Australia offers significant opportunities for Everi to extend its reach and capitalize on emerging trends in both sectors. Leveraging its expertise, Everi aims to provide tailored gaming and financial technology solutions to meet the unique preferences and needs of Australian players and businesses. This strategic move positions Everi for long-term success and strengthens its standing as a key player in the global gaming and fintech landscape.

The Australian fintech market is on a robust growth trajectory and is expected to reach USD 4.11 billion in 2024, growing at a compound annual growth rate (CAGR) of 10.32% to USD 6.72 billion by 2029. The sector is buoyed by significant digital transformation in financial services, fostering innovations like mobile wallets, paperless lending, and advanced data analytics.

Airwallex Pty Ltd is a leading fintech player, specializing in cross-border payment solutions and financial services for businesses. It operates across several key segments, including international money transfers, FX solutions, global banking services, payment infrastructure, regulatory compliance, business solutions, and technology innovation. Through these segments, Airwallex caters to the diverse needs of businesses in the global marketplace, offering seamless cross-border financial operations and positioning itself as a trusted fintech partner. A key player such as Airwallex Pty Ltd plays a pivotal role in this evolving landscape, emphasizing the dynamism of the market and the potential for new entrants such as Everi Holdings Inc.

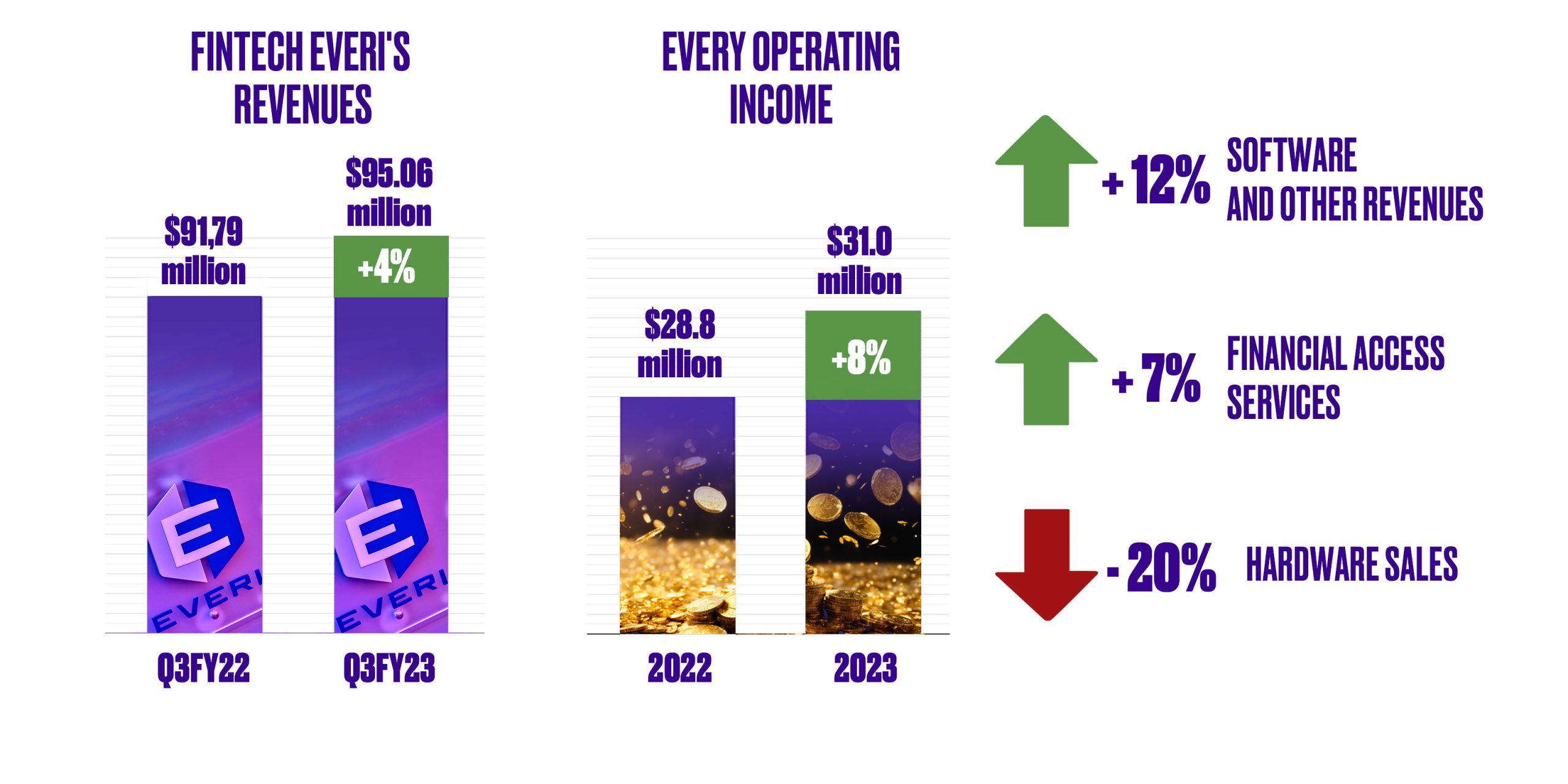

- FinTech Everi’s revenues for Q3FY23 increased 4% to 95.062 million USD compared to 91.798 million USD in Q3FY22, reflecting a 12% gain in software and other revenues and 7% growth in financial access services, partially offset by a 20% decrease in hardware sales, which compared to strong sales in the prior year related to new casino openings and expansions.

- Everi’s operating income increased 8% to $31.0 million compared to $28.8 million in the prior-year period, reflecting revenue growth from higher margin products and services partially offset by higher operating expenses and research and development expense.

Everi Holdings Inc’s interest in entering the Australian fintech market can be attributed to these growth prospects and the vibrant ecosystem of innovation. Australia is also seeing a surge in blockchain and cryptocurrency applications, highlighting the nation’s appetite for digital financial services and innovation. The governmental backing with initiatives like the Blockchain Pilot Grants further underscores the sector’s potential, making it an attractive landscape for fintech companies.

Given this context, Everi Holdings Inc might see Australia as an opportunity-rich market for expansion or introduction of new fintech services, benefiting from the region’s conducive regulatory environment, technological infrastructure, and a growing trend of digital financial adoption among consumers and businesses.

Everi Holding Inc Expansion Evaluation

Benefits for Everi in New Market Expansion

Everi excels in tailoring its offerings to meet diverse market needs, evident in its customized gaming products for American players and secure payment solutions for casinos worldwide. Backed by a robust global network, Everi is poised for successful expansion, leveraging its technological prowess. For instance, entering the Australian market allows Everi to introduce advanced gaming technology like the Empire Flex cabinet, while also adapting its payment solutions to local regulations and preferences. This strategic expansion not only boosts revenue but also solidifies Everi’s position as a leader in the gaming and fintech sectors, promising long-term shareholder value.

Risks for Everi in New Market Expansion

Expanding into the Australian market presents Everi Holdings Inc with various risks that require effective management. Regulatory compliance poses a challenge, as Everi must navigate unfamiliar frameworks, risking fines or legal challenges for non-compliance. Market volatility is another significant risk, with uncertain economic conditions potentially impacting revenue stability. Everi faces intense competitive pressure from both local incumbents and global competitors, hindering its ability to penetrate new markets effectively. Cultural and operational challenges emerge, requiring Everi to adapt to local norms and practices, which can be complex and time-consuming. Currency exchange and economic risks are present, as Everi is exposed to fluctuations that can affect its financial performance. There’s the risk of brand perception and reputation damage, as negative perceptions or product/service issues may tarnish Everi’s credibility. To mitigate these risks, Everi must prioritize regulatory compliance, invest in talent development, and maintain adaptability to changing market conditions.

Impact on local gaming operators and financial institutions

Everi’s entry into the Australian gaming and financial industry is likely to have a positive impact on local gaming operators and financial institutions. By offering innovative gaming products and fintech solutions, Everi can help local businesses improve their operational efficiency, attract more customers, and drive revenue growth. In addition, Everi’s presence in the market creates new competition and stimulates innovation, encouraging local players to improve their offerings and services to remain competitive. Everi’s entry in the Australian market is expected to contribute to a more dynamic and competitive landscape, which is expected to benefit both industry players and consumers.

Conclusion

Everi Holdings Inc’s expansion into Australia targets gaming and finance sectors, diversifying its global presence. This move promises growth, innovation, and job creation, enhancing competition and fostering collaboration in the Australian market. Further research could explore Everi’s long-term impact on local industries and monitor its adaptation to market conditions, providing insights for stakeholders and investors.