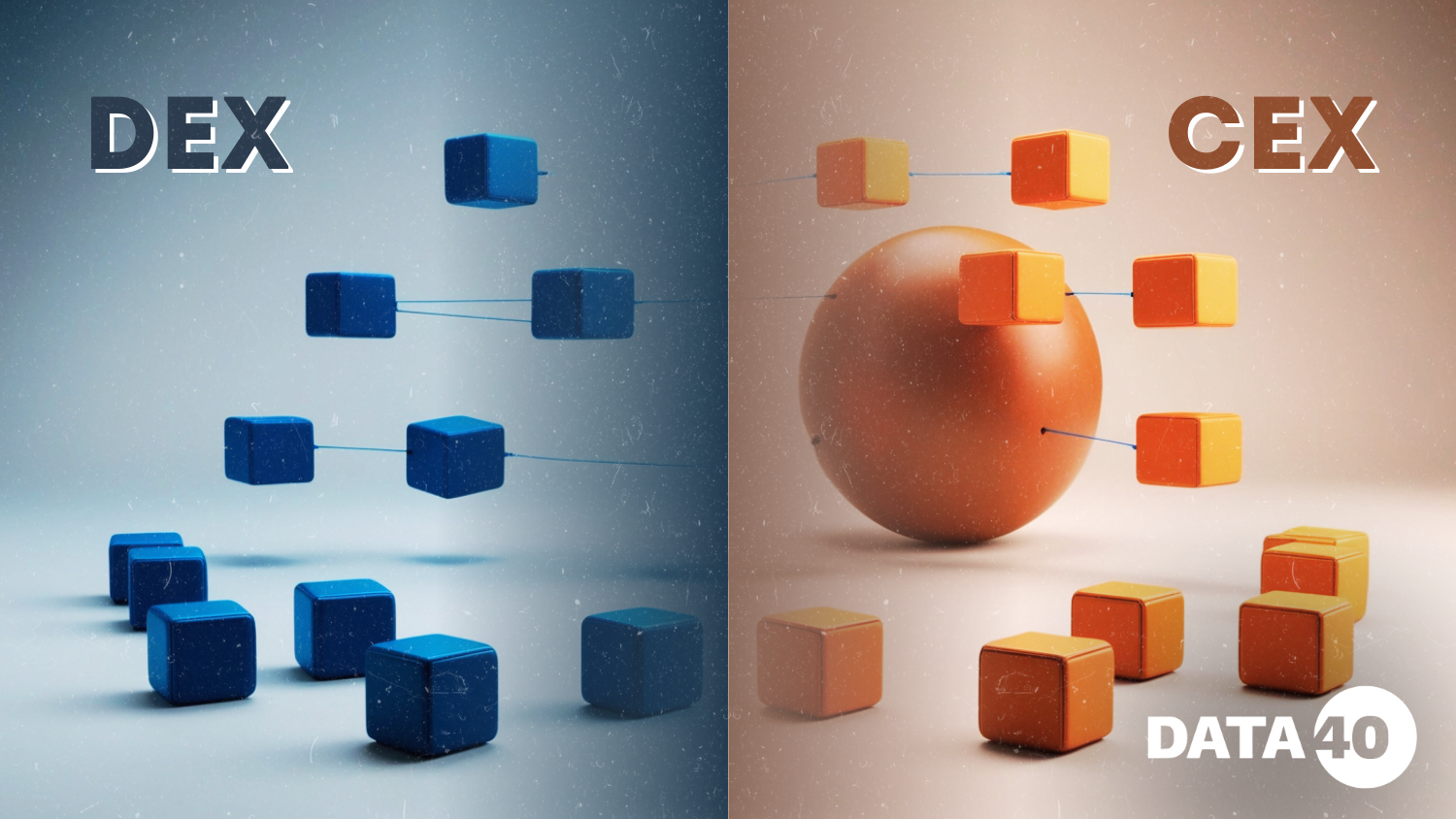

Cryptocurrency trading has revolutionized the financial world, providing opportunities for individuals to trade digital assets in ways never before possible. The backbone of this revolution lies in two types of exchanges: Centralized Exchanges (CEX) and Decentralized Exchanges (DEX). Each of these trading platforms has unique features, advantages, and drawbacks, making them suitable for different types of traders.

Understanding Centralized Exchanges

Centralized Exchanges, as the name suggests, are platforms operated by centralized companies or organizations. They act as intermediaries between buyers and sellers, managing user accounts, trades, and funds. Examples of popular CEXs include Binance, Coinbase, and Kraken.

Features of CEX

- User-Friendly Interfaces: CEXs are designed with accessibility in mind, offering intuitive interfaces that cater to beginners and seasoned traders alike. For example, Coinbase provides a simple dashboard for new users, while platforms like Binance offer advanced trading tools for experienced traders.

- High Liquidity: CEXs often have large trading volumes and liquidity pools maintained by the platform itself and external market makers. This ensures that traders can buy or sell assets quickly without significant price fluctuations.

- Regulation and Security: Most CEXs comply with regulatory standards in the regions they operate. For instance, Kraken enforces stringent KYC (Know Your Customer) policies to ensure compliance and user security. These platforms also invest in robust security measures like multi-signature wallets and cold storage.

- Additional Features: CEXs often offer advanced trading options, such as margin trading, staking, futures contracts, and even crypto savings accounts. Binance, for instance, allows users to earn interest on idle crypto assets through its staking services.

Why Choose a CEX?

CEXs are ideal for users who value convenience, liquidity, and a wide range of trading options. Their centralized nature means users have a trusted intermediary to resolve disputes or technical issues. However, this reliance on a central authority also poses risks like potential hacks and restrictions on withdrawals during regulatory interventions.

Understanding Decentralized Exchanges

Decentralized Exchanges operate without a central authority. Instead, they use blockchain technology and smart contracts to facilitate peer-to-peer transactions. Examples of well-known DEXs include Uniswap, PancakeSwap, and SushiSwap.

Features of DEX

- Self-Custody: DEXs allow users to maintain control of their funds. Instead of depositing assets into a centralized wallet, traders connect non-custodial wallets like MetaMask or Trust Wallet to the DEX. This reduces risks associated with centralized fund storage.

- Permissionless Trading: Unlike CEXs, DEXs do not require users to create accounts or undergo KYC processes. This makes them accessible to anyone with a compatible crypto wallet, offering greater privacy and freedom.

- Community-Sourced Liquidity: Liquidity on DEXs comes from liquidity pools funded by users. In return, liquidity providers earn fees from transactions. For example, Uniswap incentivizes users to contribute to pools by distributing governance tokens.

- Broad Token Access: DEXs are often the first platforms to list new or niche tokens, allowing traders to access projects before they are available on CEXs. This can be a significant advantage for investors seeking early opportunities.

Why Choose a DEX?

DEXs are perfect for those who prioritize privacy, autonomy, and decentralized governance. They eliminate the risks associated with centralized platforms, such as hacking or account suspension. However, they come with challenges like lower liquidity and a steeper learning curve for beginners.

CEX vs. DEX: A Detailed Comparison

Below is a side-by-side comparison of CEXs and DEXs, highlighting their key differences:

| Aspect | Centralized Exchanges | Decentralized Exchanges |

| Control and Authority | Operated by a central entity managing all processes. | Operates through blockchain-based smart contracts. |

| User Accessibility | Requires account creation, login credentials, and often KYC. | Accessible with just a crypto wallet. |

| Privacy Level | Personal information is mandatory for trading. | Ensures anonymity; no personal data required. |

| Transaction Speed | Off-chain processing allows faster execution. | On-chain transactions depend on blockchain speed. |

| Security Risks | Centralized storage vulnerable to hacking attempts. | Non-custodial; assets stay in user-controlled wallets. |

| Liquidity | Higher liquidity due to consolidated order books. | Relies on liquidity pools provided by the community. |

| Trading Options | Offers advanced features like margin and futures trading. | Primarily supports simple token swaps. |

| Cost and Fees | Set fees by the exchange, varying with trade volume. | Network and platform fees; often lower for small trades. |

| Regulatory Compliance | Typically complies with government regulations and audits. | Operates without mandatory regulatory frameworks. |

| Token Availability | Lists well-established and regulated tokens. | Provides access to new and less mainstream tokens. |

Why Does It Matter?

The choice between a CEX and a DEX ultimately depends on individual needs. Let’s explore some key considerations:

Security

CEXs have historically been targets of high-profile hacks, such as the Mt. Gox incident in 2014. While most reputable CEXs now employ sophisticated security measures, their centralized nature remains a point of vulnerability. DEXs mitigate this risk by enabling users to retain custody of their funds. However, they are not immune to vulnerabilities, such as poorly audited smart contracts, which have led to significant losses in the past.

Trading Options

For traders seeking complex financial instruments, CEXs offer advanced options like derivatives and margin trading. DEXs, on the other hand, primarily focus on token swaps and liquidity provision. However, newer DEX protocols are starting to introduce features like lending and perpetual swaps, bridging the gap with CEXs.

Accessibility

DEXs shine in regions with stringent regulations or limited financial infrastructure. They empower users in such areas to access global financial markets without barriers. Conversely, CEXs provide a more structured and regulated trading environment, which may be reassuring for users in regions with unclear crypto regulations.

Real-World Use Cases

Different traders and investors gravitate toward Centralized Exchanges or Decentralized Exchanges based on their specific goals, preferences, and circumstances. Here are some expanded real-world examples that illustrate why individuals might choose one over the other:

- New Traders and Beginners

A newcomer to cryptocurrency trading might prefer a platform like Coinbase, a centralized exchange known for its intuitive interface and robust customer support. These features help ease the steep learning curve often associated with crypto trading. With guided onboarding processes, educational resources, and clear navigation, CEXs like Coinbase make it simpler for beginners to execute trades, manage their portfolios, and even learn the basics of blockchain technology. - Privacy Advocates and Anonymity Seekers

For users who prioritize their privacy and anonymity, decentralized exchanges like Uniswap are a clear choice. Unlike CEXs, which often require Know Your Customer (KYC) verification processes to comply with regulations, DEXs allow traders to participate without providing personal information. This feature is particularly attractive to individuals in regions with strict financial regulations or those who wish to maintain discretion in their trading activities. - High-Volume and Professional Traders

Experienced traders who deal in large volumes or use advanced trading strategies often gravitate toward centralized exchanges like Binance or Kraken. These platforms provide the high liquidity necessary for executing significant trades without slippage and offer advanced tools such as futures contracts, margin trading, and algorithmic trading APIs. Additionally, centralized exchanges often provide detailed analytics and historical data, which are invaluable for professionals making data-driven decisions. - Token Enthusiasts and Early Adopters

Investors interested in discovering and supporting emerging blockchain projects frequently turn to DEXs like PancakeSwap. These platforms are known for listing new and unique tokens long before they appear on centralized exchanges. The ability to trade tokens early often provides access to potential high-growth opportunities, especially for those willing to explore and assess less mainstream projects. Furthermore, the permissionless nature of DEXs ensures that these tokens can be traded without needing approval from centralized gatekeepers, fostering innovation in the cryptocurrency space.

By examining these scenarios, it’s evident that the choice between a CEX and a DEX often hinges on the trader’s priorities, expertise level, and the type of trading experience they value most.

Making the Right Choice

There is no definitive answer to whether a CEX or DEX is better. Your choice should align with your trading goals, risk tolerance, and values. CEXs provide a polished and secure trading experience with regulatory oversight, while DEXs offer unmatched autonomy and privacy. Understanding these differences is key to navigating the dynamic cryptocurrency landscape effectively. By weighing the pros and cons, you can make an informed decision that best suits your needs in the ever-evolving world of crypto trading.