Churchill Downs Incorporated (CDI), the storied company best known for hosting the Kentucky Derby, has consistently expanded its influence within the gaming, racing, and entertainment sectors. Fiscal Year 2023 marked a year of substantial growth, strategic acquisitions, and notable financial performance, further solidifying CDI’s position in the market. This analysis explores CDI’s financial achievements, strategic initiatives, key acquisitions, and recent developments.

Financial Performance

CDI’s financial performance in FY2023 was particularly strong, reflecting its strategic decisions and operational efficiencies. The company reported a significant increase in net revenue, which reached $2.46 billion, marking a 36.02% increase compared to $1.81 billion in FY2022, and a remarkable 54.13% growth from $1.60 billion in FY2021. This surge in revenue was driven by the diversified structure of CDI’s operations.

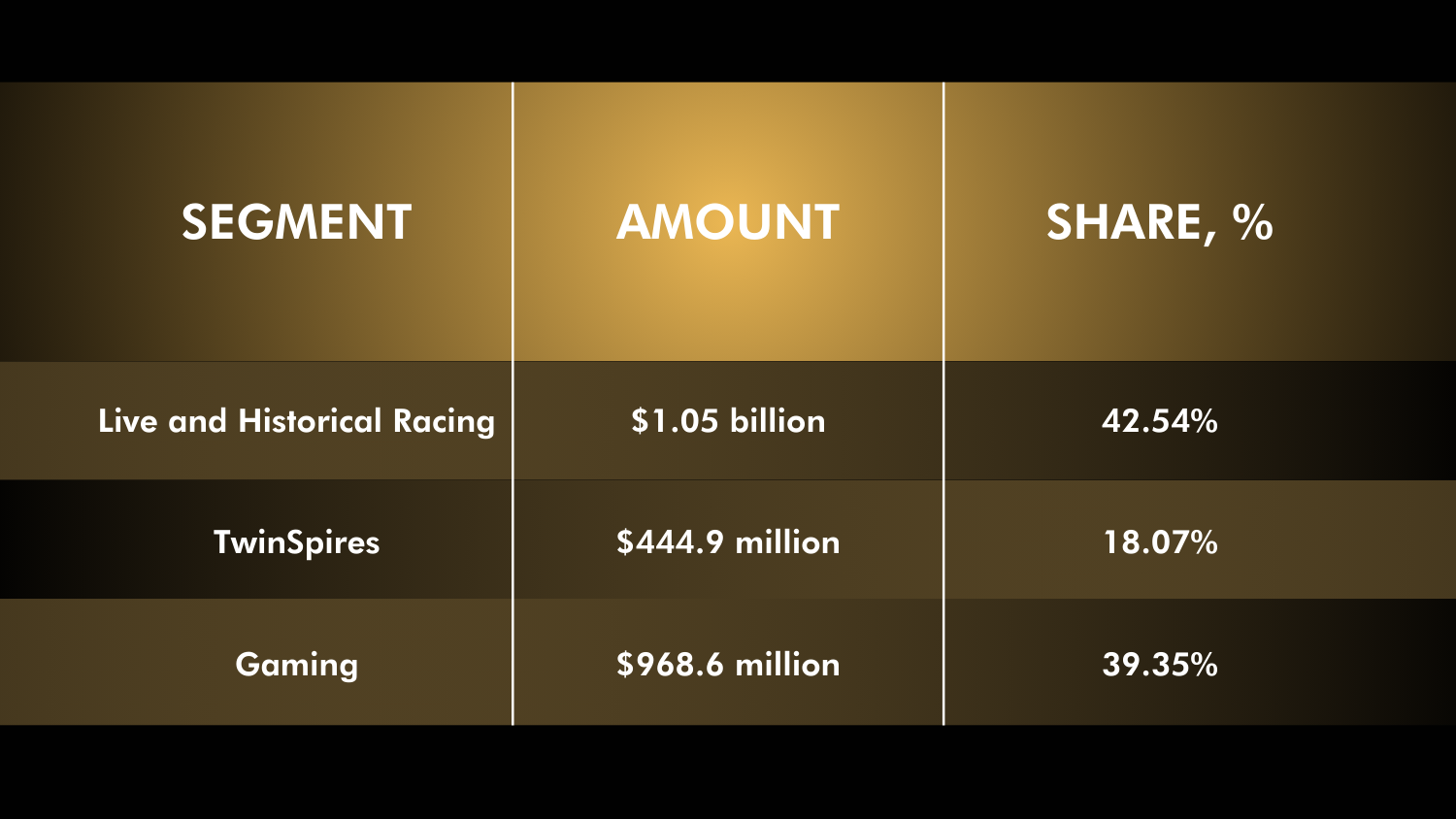

The revenue composition for FY2023 was as follows:

Operating expenses also saw an increase, rising to $1.90 billion, a 27.53% increase from $1.49 billion in FY2022, and a 44.55% increase compared to $1.31 billion in FY2021. Despite these rising costs, CDI’s focus on efficient operations and strategic acquisitions helped maintain strong profitability.

As of December 31, 2023, CDI’s Total Equity was $893.6 million, representing a 62.03% increase from $551.5 million at the end of 2022, and a staggering 191.26% increase from $306.8 million at the close of 2021. However, the company also reported Total Current Liabilities of $755.8 million, exceeding its Total Current Assets of $400.8 million by $355.0 million, indicating a significant leverage position.

Strategic Initiatives

In FY2023, CDI continued to focus on diversification and technological advancements. One of the key strategic moves was the enhancement of its online wagering platform, TwinSpires, which saw significant growth due to the rising popularity of digital betting. TwinSpires reported $444.9 million in revenue, underscoring the importance of CDI’s digital transformation strategy.

Furthermore, CDI made strategic investments in its physical gaming properties, including renovations at the Churchill Downs Racetrack to improve guest experience and capacity for its marquee events. The company also expanded its presence in various states where gaming laws have become more liberal, further strengthening its market position.

Key Acquisitions

Acquisitions have been a cornerstone of CDI’s growth strategy, and FY2023 was no exception. On August 22, 2023, CDI completed the acquisition of Exacta Systems for $248.2 million, including $241.3 million in cash and $6.9 million in deferred payments. This acquisition is expected to enhance CDI’s gaming operations and contribute positively to its bottom line.

Earlier in the fiscal year, CDI also completed the acquisition of several properties from Peninsula Pacific Entertainment (P2E) for $2.75 billion. This deal included casinos, racetracks, and a resort, significantly expanding CDI’s operational footprint.

A noteworthy historical acquisition was the sale of Big Fish Games, Inc., CDI’s mobile gaming subsidiary, to Aristocrat Technologies, Inc., which was completed on November 29, 2017. This move allowed CDI to focus on its core competencies in gaming and wagering. The sale led to a recalibration of revenue figures for 2016 and 2015, which were adjusted in CDI’s Consolidated Annual Report 2017. These historical adjustments highlight CDI’s focus on core operations and strategic realignment.

Shareholder Value and Stock Activity

CDI’s commitment to delivering shareholder value was evident in the company’s decision to increase dividends from $0.357 per share to $0.382 per share, marking a 7.00% increase from 2022 to 2023. Additionally, on May 22, 2023, CDI executed a two-for-one stock split, doubling the number of authorized shares and adjusting all share and per-share amounts retroactively. This move made CDI’s stock more accessible to a broader range of investors.

As of December 31, 2023, CDI had approximately 74.5 million shares outstanding, traded under the NASDAQ ticker symbol CHDN. The stock split and dividend increase reflect CDI’s robust financial health and its commitment to rewarding shareholders.

Recent News and Developments

In the past month, CDI has continued to make strategic moves. One notable development was the launch of BetAmerica, a new sports betting platform that aims to capitalize on the growing U.S. sports betting market. This initiative is part of CDI’s broader strategy to diversify its revenue streams and strengthen its position in the digital gaming space.

Additionally, CDI has made strides in its sustainability efforts, committing to a 30% reduction in greenhouse gas emissions by 2030. This commitment is part of the company’s broader Environmental, Social, and Governance (ESG) strategy, which underscores its dedication to sustainable growth.

Conclusion

Fiscal Year 2023 was a transformative period for Churchill Downs Incorporated, characterized by strong financial performance, strategic acquisitions, and significant shareholder returns. The company’s ability to adapt to industry trends and expand its digital presence has positioned it well for continued growth. As CDI looks ahead to FY2024, its strategic focus on diversification, technology, and sustainability will be key drivers of its ongoing success.