![Best Mobile Game Publishers: Ranked by Downloads [2024] Best Mobile Game Publishers: Ranked by Downloads [2024]](https://data40.com/wp-content/uploads/2024/04/Header.png)

The mobile gaming industry has experienced a meteoric rise, becoming a cornerstone of the global entertainment market. With its accessibility and wide-ranging appeal, mobile gaming has democratized gaming, allowing people from all walks of life to engage in interactive entertainment. The proliferation of smartphones and advancements in technology have fueled this growth, making high-quality gaming experiences available in the palm of one’s hand.

This article presents 15 companies ranked by the number of downloads for 2023. In addition, here you will find information about how much it costs to publish your game, what promotion strategies modern companies offer, as well as learn about modern business models that help developers make their games the most popular. And, of course, all the information is supplemented with examples of well-known mobile games.

Best Mobile Game Publishers

| Company | CEO | Established | Headquarters | Employees | Revenue |

|---|---|---|---|---|---|

| Mark Ren | 2003 | Shenzhen, China | 108 436 | $53 billions |

| Yegor Vaikhanski | August 2017 | Europe, Middle East, and Africa (EMEA), European Union (EU), Middle East | 250 | $1 billion |

| Shuntaro Furukawa | September 23, 1889 | 11–1 Kamitoba Hokodatecho, Minami-ku, Kyoto, Japan | 7 317 (2023) | $13,9 billions (2023) |

| Dmitry Yaminsky | 2017 | Nicosia (Cyprus) | 325 | $9 billions |

| Ryutaro Ichimura | June 1997 | Hangzhou, Zhejiang, China | 18,129 (December 2017) | $59,24 B |

| Narendra Singh | December 27, 2008 | Great Lakes, Midwestern US | 500 | $9 billions |

| Tjodolf Sommestad | August 2003 | Stockholm, Sweden London, England | 6322 | $1,8 billions |

| Johanna Faries | July 9, 2008 | Santa Monica, California, US | 17 000 (2023) | $8,7 billions |

| Andrew Wilson | May 27,1982 (Mobile in 2004) | Los Angeles, California, United States | 13 400 (2023) | $7,4 billions |

| Ilkka Paananen | 14 May 2010 | Helsinki, Finland | 480 (2023) | $1,8 billions |

| John Hanke | 2010 | San Francisco, California, U.S. | 800 (2023) | $3,4 billions |

Sony Interactive Entertainment Sony Interactive Entertainment | Jim Ryan | April 1, 2016 | San Mateo, California, U.S | 12 700 (2023) | $26,9 billions |

| David Darling | 2011 | Leamington Spa, England | 397 | $1,4 billions |

| Tomoaki Imanishi | February 5, 1992 | Chiyoda, Tokyo, Japan | 21 | $7,8 millions |

| Yves Guillemot | 28 March 1986 | Saint-Mandé, France | 19 410 (2023) | $101 millions |

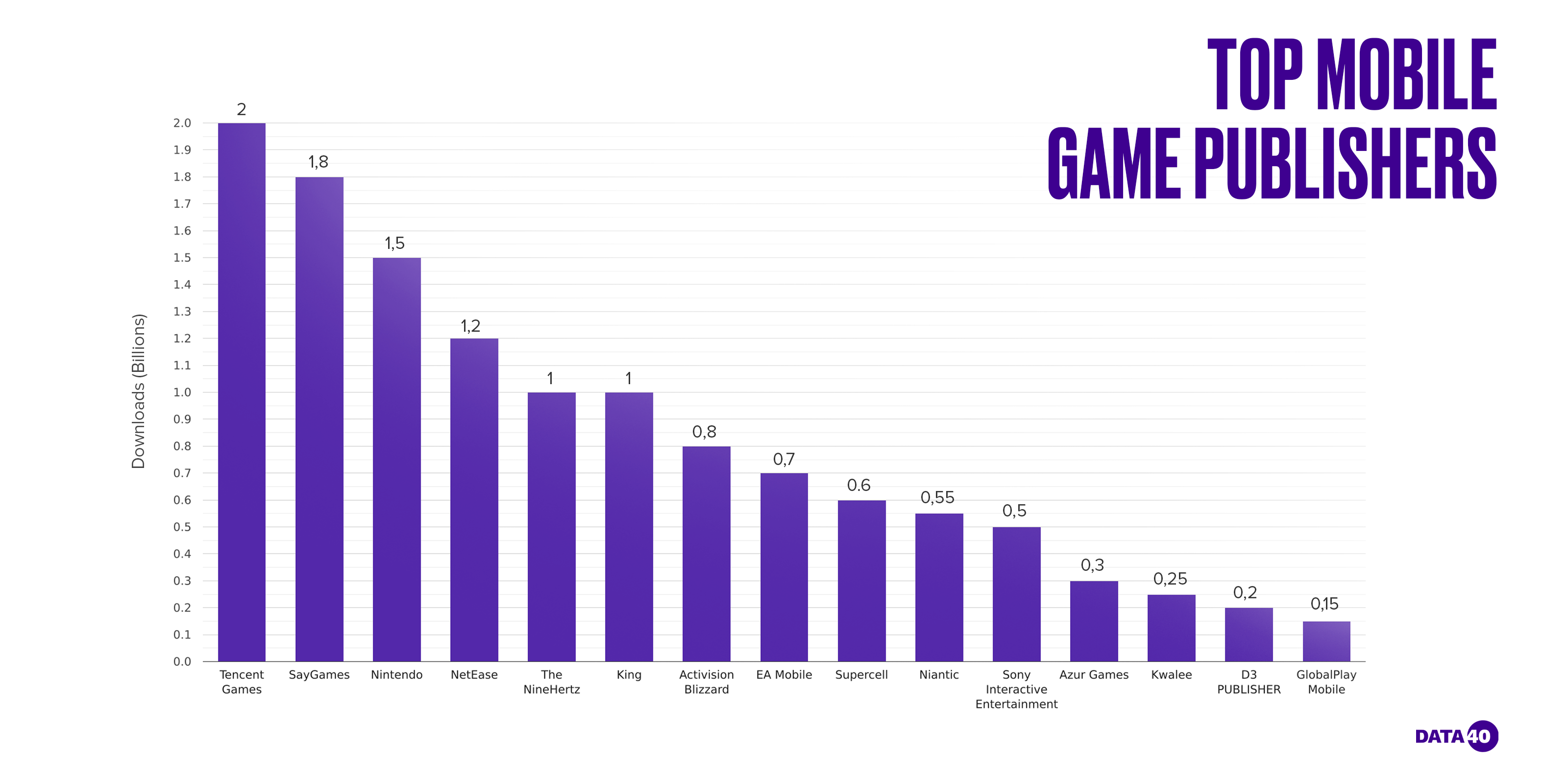

The graph shows all the companies listed below that publish games. The rating is based on the number of downloads.

Tencent Games

Founded: 2003

Downloads: 2 Billion

Country: China

Tencent Games, a juggernaut in the mobile gaming industry, boasts phenomenal successes with titles like “Honor of Kings” and “PUBG Mobile,” collectively amassing billions of downloads globally. Their approach encompasses a broad spectrum of genres, appealing to a diverse audience worldwide, while also delving into esports to foster a robust gaming community. Tencent’s expertise in in-app purchases and advertising offers developers lucrative monetization avenues, ensuring profitability alongside user engagement. SayGames, known for hyper-casual hits like “Sand Balls” and “Johnny Trigger,” emphasizes simplicity and addictiveness, leading to hundreds of millions of downloads. They specialize in ad-based revenue models and in-app purchases, guiding developers towards maximizing earnings while maintaining engaging gameplay.

SayGames

Founded: 2016

Downloads: 1.8 Billion

Country: Belarus

SayGames, with its hyper-casual games, showcases the potential of ad-based revenue models and in-app purchases in driving profitability while keeping games free and accessible. Their approach provides a template for developers looking to capitalize on the vast user base of casual gamers. Nintendo’s transition of its beloved franchises to mobile platforms not only broadens its audience but also introduces innovative monetization strategies that respect the user experience. Their model offers valuable lessons in balancing premium and freemium content, ensuring long-term player engagement and brand loyalty.

Nintendo

Founded: 1889

Downloads: 1.5 Billion

Country: Japan

Nintendo’s foray into mobile gaming with iconic franchises such as “Super Mario Run” and “Animal Crossing: Pocket Camp” has resulted in over a billion downloads, underpinning their strategy of extending console-quality experiences to mobile platforms. They adeptly balance premium pricing models with freemium elements, providing a monetization blueprint that respects player experience and brand integrity. NetEase’s “Fantasy Westward Journey” and “Knives Out” have captured significant attention, especially in Asia, with their combined downloads reaching over a billion. Their development strategy marries rich storytelling with innovative gameplay, catering to both hardcore and casual gamers, while their monetization strategies, including freemium models and microtransactions, offer developers diverse revenue streams.

Azur Games

Founded: 2016

Downloads: 1,5 billion

Country: Cyprus

Azur Games stands out in the hyper-casual gaming segment, with a portfolio featuring hits like “Stack Ball” and “WormsZone.io,” which collectively contribute to hundreds of millions of downloads. Their success is rooted in creating highly addictive, easy-to-play games that appeal to a wide demographic, making them a go-to publisher for developers in the hyper-casual space. Azur’s monetization strategy heavily relies on ad revenue, integrating unobtrusive advertising within the gameplay loop, complemented by in-app purchases for cosmetic upgrades and gameplay enhancements. They excel in market analysis and trend prediction, swiftly developing and launching games that capture the current gaming zeitgeist. For game developers, Azur Games offers a blueprint for capitalizing on the hyper-casual market, emphasizing rapid development cycles, effective ad integration, and data-driven decision-making to maximize player engagement and profitability.

NetEase

Founded: 1997

Downloads: 1.2 Billion

Country: China

NetEase’s “Fantasy Westward Journey” and “Knives Out” have collectively achieved 1.2 billion downloads, capitalizing on the vast Asian market. The company blends rich storytelling with innovative gameplay, appealing to both hardcore and casual gamers. NetEase supports developers with monetization through diversified strategies, including freemium models, microtransactions, and seasonal passes. Their focus on high-quality content and player retention strategies ensures a steady revenue stream for developers within their ecosystem.

The NineHertz

Founded: 2008

Downloads: 1 Billion

Country: India

NetEase’s success in the Asian market, particularly with titles that blend rich narratives with engaging gameplay, underscores the importance of cultural resonance and innovative game mechanics in capturing a dedicated player base. Their monetization strategies, which include a mix of microtransactions and seasonal content, provide a roadmap for developers aiming to monetize content without disrupting the gaming experience. The NineHertz’s focus on immersive strategy and RPG games demonstrates the potential of deep, story-driven content to engage players and drive downloads. Their expertise in integrating monetization strategies like in-app purchases and reward-based ads into the game narrative offers developers a way to enhance gameplay while generating revenue.

King

Founded: 2003

Downloads: 1 Billion

Country: Sweden

King has become a household name in the mobile gaming industry, largely due to the unprecedented success of “Candy Crush Saga,” a game that redefined the puzzle genre and continues to captivate millions of users daily. This title, along with others like “Bubble Witch” and “Farm Heroes,” has propelled King to over a billion downloads, a testament to their mastery in creating addictive, casual games that appeal to a broad audience. King’s focus is on user engagement and retention, employing a freemium model where the games are free to play, but players can purchase in-game items or extra lives to enhance their gaming experience. They have perfected the art of integrating unobtrusive yet effective in-app purchases and advertisements, providing a steady revenue stream while maintaining a positive user experience. King also leverages data analytics to understand player behavior, allowing them to tailor updates and new releases to user preferences, thus maximizing both player satisfaction and profitability. Their approach offers valuable insights for developers into maintaining balance between monetization and user experience, ensuring long-term success in the competitive mobile gaming market.

Activision Blizzard

Founded: 2008

Downloads: 800 Million

Country: United States

Activision Blizzard has surged in mobile gaming with “Call of Duty: Mobile,” significantly contributing to their 800 million downloads. Leveraging their established franchises, they’ve attracted a broad audience, optimizing PC and console titles for mobile platforms. Their monetization strategies focus on in-app purchases and battle passes, providing value to players while driving revenue. Activision Blizzard’s expertise in creating immersive experiences helps developers craft compelling content with effective monetization models.

Electronic Arts (EA) Mobile

Founded: 1982 (EA’s founding year; EA Mobile division established later)

Downloads: 700 Million

Country: United States

Electronic Arts (EA) Mobile has successfully extended its diverse portfolio of sports, simulation, and strategy games to the mobile platform, with standout titles like “FIFA Mobile,” “Madden NFL Mobile,” and “The Sims Mobile” collectively garnering hundreds of millions of downloads. By adapting beloved console and PC game franchises for mobile, EA Mobile has tapped into an existing fan base while attracting new players with accessible, on-the-go gameplay experiences. Their monetization strategy encompasses a mix of in-app purchases, such as player packs in sports games or currency in simulation games, alongside ad revenue, offering a multifaceted approach to revenue generation. EA Mobile’s live events and content updates keep the player community engaged and open up additional revenue streams through limited-time offers and event-based purchases. Furthermore, their approach to cross-platform play and account syncing in certain titles encourages player loyalty and increases the lifetime value of each user. For game developers, EA Mobile’s strategies provide a roadmap for leveraging existing IP, diversifying revenue streams, and enhancing player engagement to drive success in the mobile gaming market.

Supercell

Founded: 2010

Downloads: 600 Million

Country: Finland

Supercell has carved out a niche in the mobile gaming industry with a focus on creating deeply engaging, community-centric strategy games like “Clash of Clans,” “Clash Royale,” and “Brawl Stars,” which have collectively surpassed a billion downloads. Their development philosophy centers on small, autonomous teams working on projects they are passionate about, leading to innovative, high-quality games that resonate with players worldwide. Supercell’s monetization strategy is built around microtransactions for in-game currency and resources, enabling players to accelerate progress, which has proven highly effective without detracting from the gameplay experience. They also emphasize regular content updates and in-game events to keep the community active and engaged, further driving in-game purchases. The company’s success in fostering vibrant game communities and implementing balanced monetization models provides valuable lessons for developers in creating sustainable, profitable mobile games that prioritize player satisfaction. Supercell’s approach demonstrates the potential of a player-first development philosophy combined with smart monetization tactics to achieve long-term success in the competitive mobile gaming landscape.

Niantic

Founded: 2010

Downloads: 550 Million

Country: United States

Niantic has redefined mobile gaming with the launch of “Pokémon GO,” a game that fused augmented reality (AR) with geolocation to create a global phenomenon, leading to over a billion downloads. Their innovative approach extends to other titles like “Harry Potter: Wizards Unite” and “Ingress,” which also leverage AR to merge the digital gaming experience with the physical world, encouraging exploration and social interaction. Niantic’s monetization strategies are as inventive as their games, focusing on in-app purchases for items that enhance the gameplay, such as Poké Balls and raid passes, and partnerships with real-world brands for sponsored locations. They prioritize user engagement and community events, which not only sustain player interest but also drive recurring revenue. For developers, Niantic exemplifies how integrating cutting-edge technology with creative gameplay can open up new revenue avenues while delivering captivating experiences.

Sony Interactive Entertainment

Founded: 1993

Downloads: 500 Million

Country: Japan

Sony Interactive Entertainment has successfully expanded its esteemed PlayStation franchises to mobile platforms, with titles like “Uncharted: Fortune Hunter” and adaptations of “God of War” amassing millions of downloads. By offering mobile versions of their popular console games, Sony caters to a broader audience, maintaining high-quality storytelling and gameplay that align with their console counterparts. Their mobile strategy includes premium pricing for full game access and in-app purchases for additional content, ensuring that mobile games contribute to their revenue streams without compromising the gaming experience. Sony’s approach to mobile gaming emphasizes the extension of their gaming ecosystem, providing a seamless experience for players across devices.

Kwalee

Founded: 2011

Downloads: 250 Million

Country: United Kingdom

Kwalee has rapidly gained recognition in the mobile gaming industry with its focus on hyper-casual games, leading the charge with titles like “Draw It” and “Shootout 3D” that have collectively amassed hundreds of millions of downloads. Their approach is centered around a creative-led development process, encouraging innovation and experimentation among their teams to produce games that capture and retain a wide audience’s attention. Kwalee utilizes a data-driven strategy to refine gameplay and monetization, effectively incorporating ads and in-app purchases that complement the gaming experience without detracting from it. They specialize in identifying and capitalizing on current trends, enabling rapid development and release cycles that keep pace with the ever-changing preferences of mobile gamers.

D3 PUBLISHER

Founded: 1992

Downloads: 200 million

Country:Japan

D3 PUBLISHER has carved a niche in the gaming industry, particularly in the realms of action, puzzle, and strategy games. Notable for series like “Earth Defense Force” and “Puzzle Quest,” the company has garnered a loyal fan base, with its games often celebrated for their quirky and innovative concepts. D3 PUBLISHER adopts a unique approach to game development, emphasizing the creation of accessible, entertaining games that appeal to both hardcore gamers and casual players. Their strategy often involves closely monitoring gaming trends and player feedback to adapt and evolve their game offerings accordingly. The company also has a strong international presence, with many of its games available globally, often localized to suit different regions. This global strategy has enabled D3 PUBLISHER to reach a wide audience, further expanding its impact in the gaming community. By focusing on delivering engaging gameplay experiences coupled with a keen eye for market trends, D3 PUBLISHER continues to be a prominent player in the gaming industry, contributing significantly to the diversity and richness of the global gaming landscape.

Ubisoft

Founded: 1986

Downloads: Over 100 Million

Country: France

Ubisoft’s prominence in the global gaming industry is marked by its innovative approach to game design, particularly through franchises like “Assassin’s Creed” and “Far Cry” that masterfully blend compelling narratives with immersive gameplay. This blend has been instrumental in appealing to a wide audience, thereby securing a strong foothold in markets across continents. Their dedication to creating games that offer rich, historical contexts intertwined with fictional storytelling has set a new standard for narrative depth in gaming. Their monetization model is multifaceted, incorporating elements such as game sales, downloadable content (DLC), season passes, microtransactions, and a subscription service, Ubisoft+. This strategy not only caters to a variety of player preferences but also ensures a steady revenue stream while maintaining player engagement through continuous content updates and expansions.

How Much Does Publishing a Mobile Game Cost?

Publishing a mobile game involves various costs that can range significantly depending on the scope of the game, the platform, marketing efforts, and the level of support required from the publisher. The cost range for publishing a mobile game can vary widely, from a few thousand dollars for indie developers to millions for high-end games developed by established studios. For instance, a simple game developed by an independent developer might only require minimal publishing costs, possibly under $10,000, primarily for app store fees, basic marketing, and some legal expenses. On the other hand, a more complex game with high-quality graphics, multiplayer features, and extensive content could see publishing costs soaring into the hundreds of thousands or even millions, especially if it involves significant marketing campaigns and post-launch support.

Example costs from different publishers illustrate this variability. A publisher like Kwalee, focusing on hyper-casual games, might offer relatively low-cost publishing solutions that include market analysis, optimization, and user acquisition strategies, with costs primarily based on revenue-sharing models. In contrast, a company like Tencent or Electronic Arts (EA) Mobile, dealing with more complex games, might involve higher upfront costs for marketing, localization, and extensive user testing, in addition to revenue share or licensing fees.

Several factors influence the costs of publishing a mobile game. Development complexity is a significant factor; more sophisticated games with advanced graphics and features like online multiplayer or AR/VR components will incur higher costs. Marketing and user acquisition strategies also play a crucial role; a game that requires a global marketing campaign with influencer partnerships and paid advertising will be much costlier to publish. Other factors include the target platforms (iOS, Android, or both), ongoing support and updates, server costs for multiplayer games, and any licensing fees if the game includes branded content or intellectual property. Understanding these factors can help developers and publishers strategically plan their budgets and choose the right publishing partner to maximize their game’s potential while keeping costs manageable.

How Mobile Gaming Publishers Help to Promote Products

Marketing and Promotion Strategies

Mobile gaming publishers play a pivotal role in the success of a game through effective marketing and promotion strategies, leveraging their resources and expertise to reach a wide audience. They employ a variety of strategies to promote products, including targeted advertising campaigns across social media platforms, search engines, and in-app advertisements in other games to captivate potential players’ attention. Influencer marketing is another critical strategy, where publishers collaborate with gaming influencers and content creators to showcase the game to their followers, often leading to a significant uptick in downloads and engagement.

Publishers also utilize app store optimization (ASO) techniques to improve the game’s visibility and attractiveness on platforms like the Apple App Store and Google Play Store. This includes optimizing the game’s title, description, and keywords, and using compelling visuals and video trailers to stand out in the crowded app marketplace. Additionally, publishers often arrange for press releases and reviews from reputable gaming websites and forums to build credibility and generate buzz around a game’s launch.

Success Stories and Case Studies

Success stories and case studies abound in the mobile gaming industry, highlighting the impact of effective promotion. For instance, Supercell’s “Clash of Clans” benefited from a comprehensive marketing strategy that included memorable TV commercials, social media campaigns, and collaborations with popular YouTubers, contributing to its status as one of the highest-grossing mobile games. Similarly, the launch of “Pokémon GO” by Niantic showcased the power of leveraging a beloved franchise and innovative AR technology, paired with viral marketing tactics that led to unprecedented download numbers and a cultural phenomenon.

Another notable case is the collaboration between Tencent Games and Activision for the launch of “Call of Duty: Mobile,” which utilized Tencent’s vast marketing network and expertise in mobile gaming to successfully adapt a classic console game for mobile platforms, achieving over 100 million downloads in its first week. These examples underscore the vital role of publishers in not just bringing a game to market, but in strategically promoting it to ensure its success and longevity in the competitive mobile gaming landscape.

Mobile Game Business Models

Mobile game business models have evolved significantly, shaping the industry’s revenue streams and impacting the overall gaming landscape. The most prevalent models include:

- Freemium Model: This model offers the game for free but charges for additional features, content, or virtual goods. Games like “Candy Crush” by King exemplify this, where players can download and play for free but have the option to purchase in-game items to enhance their experience or progress faster. This model has become ubiquitous in the mobile gaming industry due to its ability to attract a broad audience by lowering the entry barrier, while still generating revenue from dedicated players willing to pay for enhancements.

- In-App Advertising: Games adopting this model remain free to play, but revenue is generated through advertisements within the game. Developers may offer players the option to watch ads in exchange for in-game rewards or include banner and interstitial ads during gameplay. This model can be seen in many hyper-casual games, where the gameplay is straightforward, and sessions are short, making ad integrations less intrusive.

- Paid Games: Some games are available for a one-time upfront purchase. This model, although less common in the mobile space, is prevalent for games that offer a comprehensive and ad-free experience from the outset. Classic games ported to mobile platforms, such as those from the “Final Fantasy” series by Square Enix, often use this model.

- Subscription Model: A newer model in the mobile gaming industry, subscriptions offer players access to a library of games or premium game content for a recurring fee. Apple Arcade and Google Play Pass are prime examples, providing ad-free experiences, exclusive content, and a wide variety of games for a monthly subscription fee.

- Battle Passes/Season Passes: Popularized by games like “Fortnite,” this model involves players purchasing a pass that unlocks a series of rewards as they achieve certain milestones or complete specific challenges within a set period. This model encourages continuous engagement and provides developers with a predictable revenue stream.

These business models significantly impact the mobile gaming industry’s landscape. The freemium model and in-app advertising have democratized game access, allowing more players to engage with mobile gaming than ever before. However, they’ve also led to concerns about game balance and the ethical implications of monetizing through microtransactions and ads. The subscription and season pass models are shaping a new direction for mobile gaming, emphasizing value and sustained engagement over sporadic purchases.

FAQ

Top-grossing publishers stand out due to their ability to blend high-quality game development, effective monetization strategies, and powerful marketing, alongside a deep understanding of their audience's preferences. They leverage vast resources to ensure polished gameplay experiences and maintain player engagement through community building and data analytics.

Mobile game business models have transitioned from simple paid downloads to more complex freemium and in-app advertising models, with recent shifts towards subscription services and battle passes focusing on sustained player engagement and providing continuous content.

Future trends in mobile gaming include the increased integration of AR and VR technologies for immersive experiences, the rise of cloud gaming for high-quality streaming on mobile devices, and the expansion of social and multiplayer features to enhance community engagement, alongside the potential impact of blockchain and NFTs in game asset ownership.